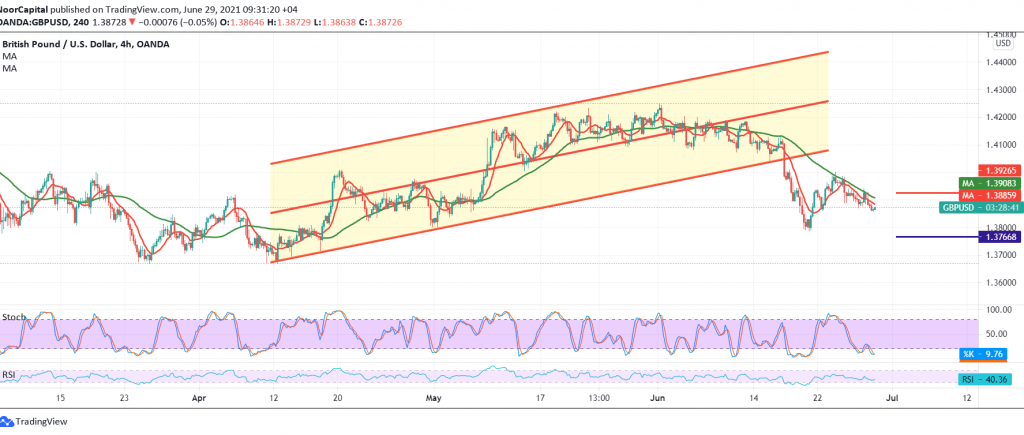

The Sterling Pound started its weekly trading with negativity to start pressing the strong support level 1.3880, and as we mentioned previously that breaking the mentioned support is a sign of bearish movements.

On the technical side today, and by looking at the 4-hour chart, we find that the simple moving averages continue their negative pressure on the price from above, accompanied by the RSI gaining bearish momentum on the short intervals.

Therefore, the bearish scenario will remain valid and effective, targeting 1.3840 and then 1.3810 respectively, knowing that breaking the latter will extend the losses to visit 1.3760 later. To remind you that activating the suggested scenario depends on the stability of daily trading below 1.3920.

Note: the level of risk is high

| S1: 1.3840 | R1: 1.3920 |

| S2: 1.3810 | R2: 1.3970 |

| S3: 1.3760 | R3: 1.4000 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations