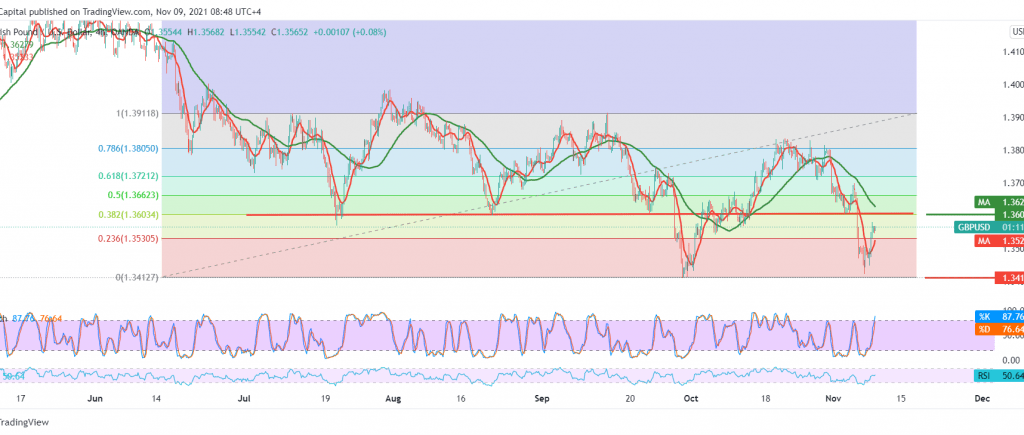

The British pound succeeded in achieving the retest target published during the previous technical report, touching the awaited retest target around 1.3570, recording its highest level at 1.3580.

Technically, by looking at the 4-hour chart, we notice that stochastic is gradually losing bullish momentum, which increases the possibility of witnessing a negative trading session that targets 1.3485, taking into account that breaking the target level facilitates the task required to visit the strong support 1.3420.

The above-expected decline depends on the pound sterling’s stability below the previously broken support-into-resistance level at 1.3610, 38.20% Fibonacci correction. Suppose the breach of the strong supply level represented by the 1.3610 resistance is confirmed. In that case, this will postpone the chances of a decline, and we may witness a slight bullish bias that targets 1.3665, 50.0% correction before starting the decline again.

| S1: 1.3485 | R1: 1.3610 |

| S2: 1.3400 | R2: 1.3665 |

| S3: 1.3350 | R3: 1.3745 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations