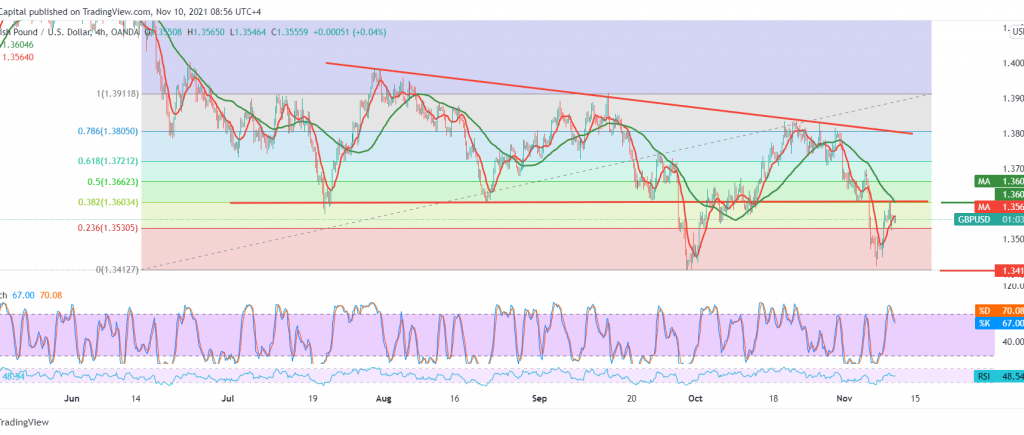

The resistance levels at 1.3610, mentioned during yesterday’s technical report, managed to limit the slight bullish bias that targeted a retest of 1.3610, bringing the British pound back to the intraday stability below the mentioned level.

Technically, looking at the 4-hour chart, we notice that stochastic is gradually losing bullish momentum, which increases the possibility of witnessing a negative trading session that targets 1.3485, taking into account that breaking the target level facilitates the task required to visit the strong support 1.3420.

The above-expected decline depends on the pound sterling’s stability below the previously broken support level, which is now turned to the 1.3610 resistance level represented by the 38.20% Fibonacci correction. Suppose the breach of the strong 1.3610 resistance is confirmed. In that case, this will postpone the chances of a decline, and we may witness a slight bullish bias that targets 1.3665, 50.0% correction before starting the decline again.

| S1: 1.3485 | R1: 1.3610 |

| S2: 1.3400 | R2: 1.3665 |

| S3: 1.3350 | R3: 1.3745 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations