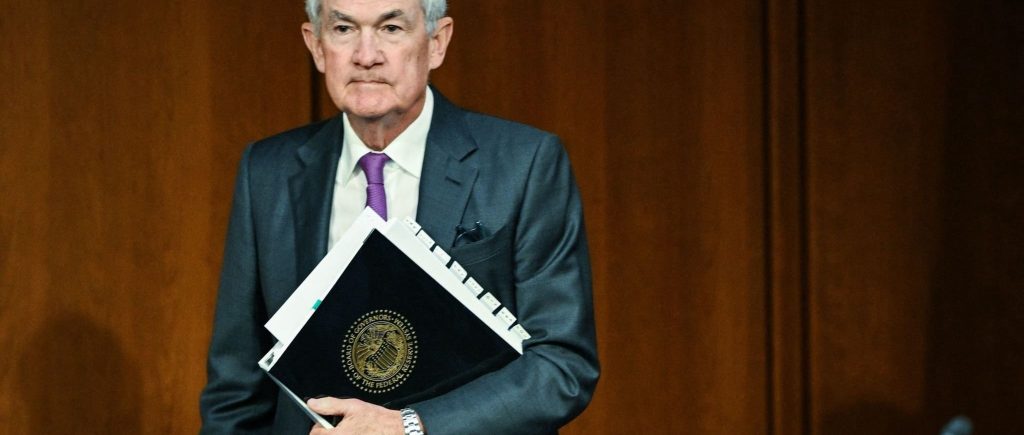

President Jerome Powell is expected to deliver new monetary policy cues later this week, but while many aren’t expecting the Fed chief’s remarks to be laced with the ‘pain’ warning from last year, there are concerns that he may raise the prospect of higher longer-term interest rates.

According to Goldman Sachs, Chair Powell’s statements are unlikely to carry the same “pain” warning as last year, but the overall theme appears to be one of “seeing the job through.”

For the Fed,’seeing the job through’ most certainly entails an economy generating below-trend growth and an inflation rate that is obviously on a downward path.

Getting inflation under control, on the other hand, may push the Fed to raise its longer-run or neutral rate – a rate that neither boosts nor hinders economic development – signalling a steeper path ahead for rates.

According to Morgan Stanley, a probable shift in thinking on the neutral rate merits notice because it would suggest a movement in the expected path for the policy rate and thus the yield curve as a whole.

Markets, on the other hand, aren’t sitting around waiting for Powell to make another statement. As chances of early-year rate reduction evaporate, the bond market appears to be prepared for a more hawkish monetary policy road ahead, built with higher-for-longer rates.

On Monday, the 10-year Treasury yield surged to its highest level since 2007, as fears mount that Powell will plant the seeds for a higher neutral rate.

In June, policymakers anticipated a median estimate of the neutral rate of interest of 2.5%, meaning a real rate of interest, or “r-star,” of 0.5% (calculated by removing the Fed’s 2% inflation).

This real neutral rate of interest has remained unchanged since 2019, and given the strength of the post-Covid economy, which is less interest-rate sensitive, some have advocated for a higher neutral rate to push policy into restrictive zone, so helping to restrain growth and inflation.

According to MUFG, a run of recent data, notably a better retail sales print for July, shows there is “little justification” for Powell to turn more dovish at the Jackson Hole symposium.

While the pivoteers, who want rate reduction sooner rather than later, aren’t as numerous or as outspoken as in recent months, there are certain benefits that the Fed chairman will gladly tout when he takes the stage on Friday morning.

Unlike a year ago, when the Fed chairman cautioned that increased interest rates would “bring some pain” to consumers, Goldman Sachs thinks the present environment is considerably more reassuring, and a “soft landing looks more plausible now than at any point over the last year.”

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations