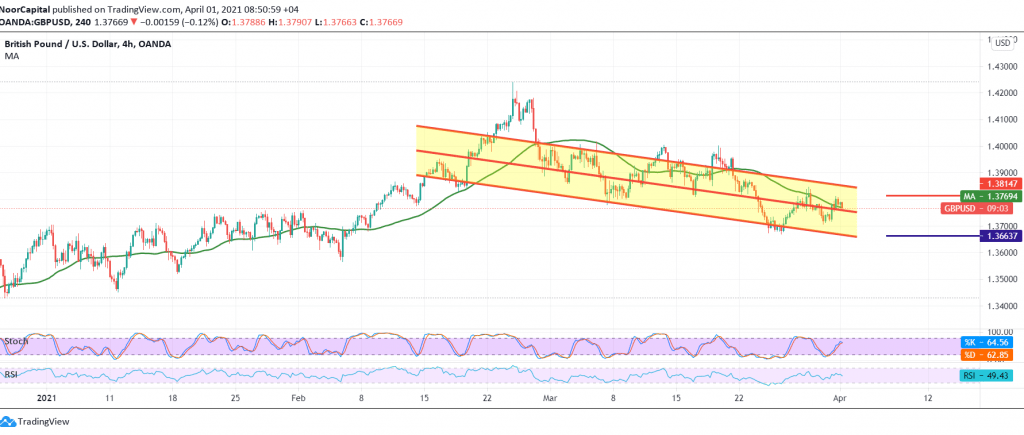

Positive trading dominated the pound’s movements against the US dollar, benefiting from the support level at 1.3710, to return to the bullish rebound to re-test the psychological barrier resistance level of 1.3800.

On the technical side today, and with a closer look at the chart, we find a contradiction between the RSI’s attempts to gain bullish momentum on short intervals, and the negative pressure coming from the 50-day moving average accompanied by the negative features that started appearing on the stochastic indicator.

We tend to be negative, but we prefer to wait for a break of 1.3725, in order to target 1.3670 a first target, and then 1.3620 a next stop.

Any trading and stability above 1.3820 is able to completely cancel the bearish scenario, and the pair will recover again, with targets starting at 1.3870 and extending to 1.3915.

| S1: 1.3725 | R1: 1.3820 |

| S2: 1.3670 | R2: 1.3870 |

| S3: 1.3620 | R3: 1.3915 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations