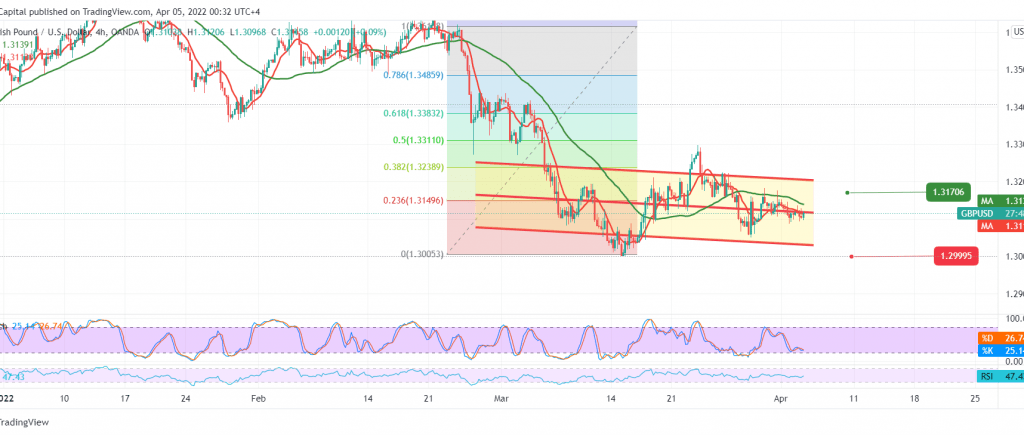

Limited positive attempts witnessed by the sterling’s movements yesterday hit the pivotal resistance level published during the previous analysis at 1.3175, which forced it to trade negatively again.

On the technical side, the pair started to pressure the previously mentioned strong support level at 1.3080. In addition, we also find the 50-day moving average exerting negative pressure on the price from above.

We need to witness a clear and robust break of 1.3075, and that will facilitate the task required to visit 1.3030, a first target, and then 1.2990, an awaited next station.

To remind that trading stability below the 1.3175 resistance level is an essential condition to activate the suggested bearish bias, and bypassing it upwards leads the British pound to recover to retest 1.3240, 38.20% Fibonacci correction.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

Reminder: Fed’s statement is due later in today’s session, and we may witness high price fluctuations.

| S1: 1.3075 | R1: 1.3170 |

| S2: 1.3030 | R2: 1.3215 |

| S3: 1.2980 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations