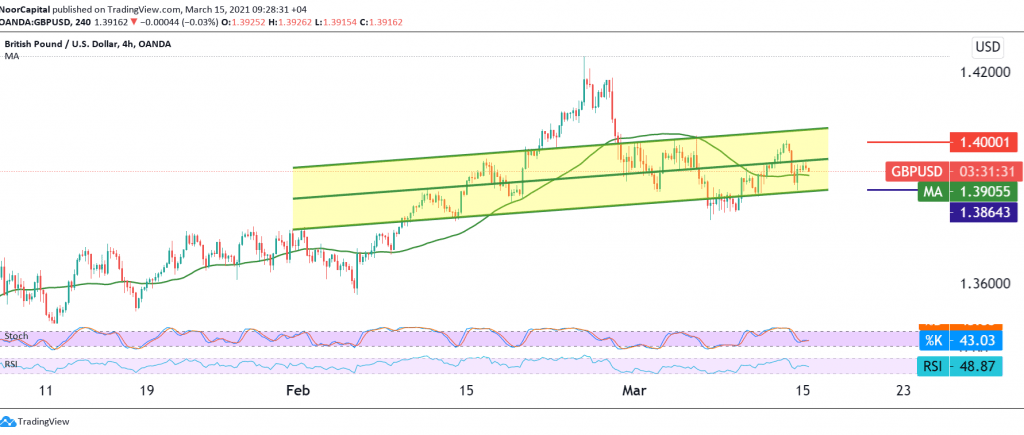

The British Pound collided for the second session in a row with the psychological barrier resistance 1.4000, which forced it to re-test the 1.3865 support level.

Technically speaking, trades are still crammed from the bottom below 1.4000 and from the top above 1.3875, and with a closer look at the chart, we find the 50-day moving average trying to push the price higher, and this comes in conjunction with the positive signs of the RSI on short time frames.

We tend to be positive, but cautiously, with trading remaining above 1.3875 / 1.3865, noting that the breach of the psychological barrier of 1.4000 increases and accelerates the strength of the bullish bias, so that we are waiting for 1.4070, and gains may extend later towards 1.4120.

From below, a break of 1.3865 / 1.3855 will immediately stop any attempts to rise, and the British pound witnesses downside moves, the initial target of which is 1.3720.

| S1: 1.3855 | R1: 1.4000 |

| S2: 1.3790 | R2: 1.4070 |

| S3: 1.3720 | R3: 1.4130 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations