The pound sterling is trading in clear negativity against the US dollar, as we expected, depending on the bearish technicals mentioned in the previous analysis, touching its first negative target at 1.3445, reaching its lowest level at 1.3450.

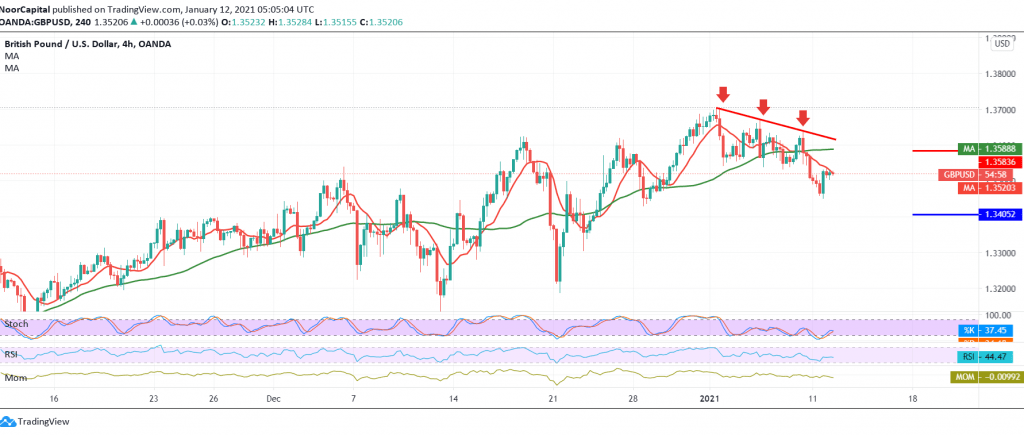

On the technical side, and by looking at the 4-hour chart, we find the 50-day moving average is still continuing the negative pressure on the price from the top, and it meets around 1.3580 and adds more strength.

With the continued negative impact of the technicals shown on the chart. Therefore, the bearish scenario will remain valid, knowing that trading below 1.3450 facilitates the mission required to visit 1.3400/1.3395, a first target that may extend later towards 1.3340.

on the upside, rising again above 1.3580 negates the bearish scenario, and we may witness a bullish intraday path that targets a re-test of 1.3630 resistance.

Note: the level of risk may be high.

| S1: 1.3460 | R1: 1.3580 |

| S2: 1.3395 | R2: 1.3635 |

| S3: 1.3335 | R3: 1.3700 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations