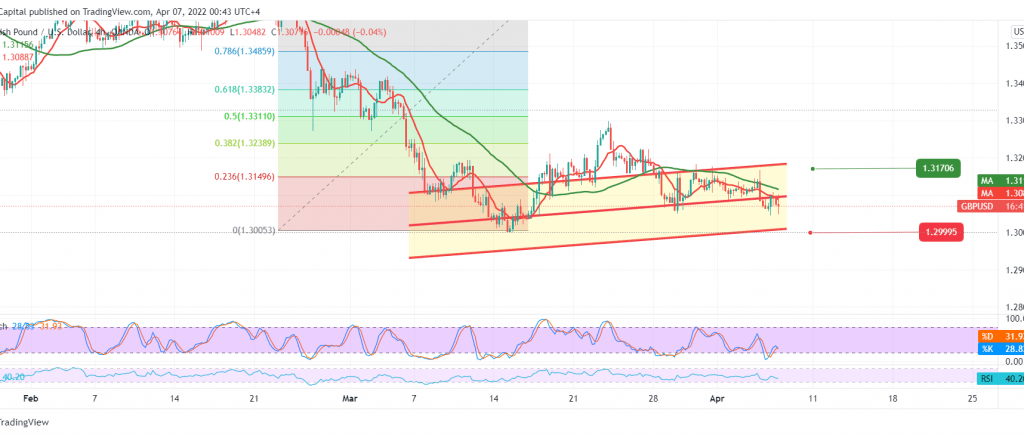

After two sessions in a row, waiting for the confirmation of breaking the support level of 1.3080, as we made it clear that increases the negative pressure on the pair and facilitates the task required to visit 1.3030, so that the pair succeeded in breaking the mentioned support, heading towards the target by a few points, recording the lowest 1.3045.

On the technical side today, and by looking at the 4-hour chart, we find the pair gradually losing the bullish momentum shown on the stochastic indicator, in addition to moving below the 50-day moving average.

Therefore, the possibility of continuing the decline is still valid, targeting 1.3025, the next station, whose targets may extend later to visit 1.2990 and 1.2975, respectively, as long as the price is stable intraday below the psychological barrier of 1.3100 and in general below the main supply point for the current trading levels at 1.3175.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

Reminder: Fed’s statement is due later in today’s session, and we may witness high price fluctuations.

| S1: 1.3025 | R1: 1.3170 |

| S2: 1.2975 | R2: 1.3215 |

| S3: 1.2900 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations