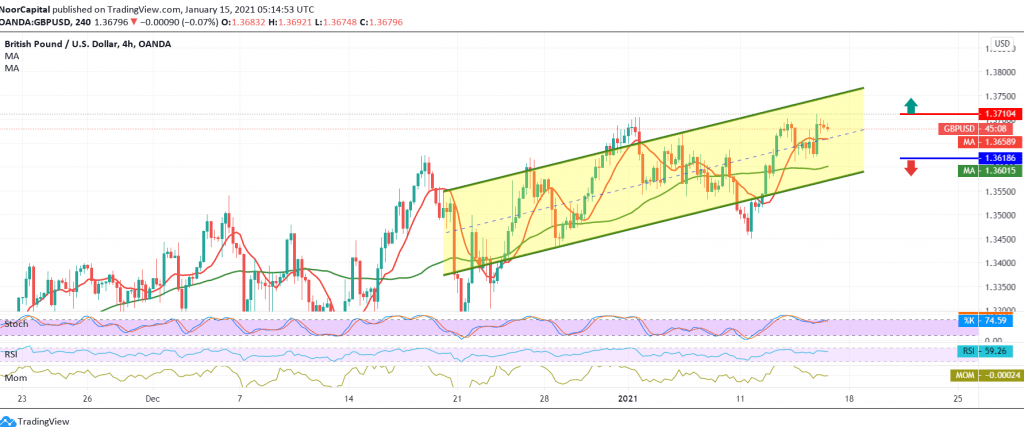

The British Pound found a solid support level around the first target published in the previous analysis at 1.3610, to hit its lowest level at 1.3616.

On the technical side, the current moves tend to be positive, with the return of trading stability above 1.3630 accompanied by the stability of the RSI indicator above the mid-50 line, coinciding with the positive stimulus coming from the 50-day moving average that came back to hold the price from below.

Technical factors support the upside, but the clear negative signs on Stochastic make us postpone the expectation of long positions until confirmation of the breach of the pivotal resistance 1.3710 / 1.3720, and its breakout confirms the strength of the daily bullish trend, with the first target of 1.3765 and extending later to 1.3810.

Trading again below 1.3610 will immediately stop any attempts to rise and put the price under strong negative pressure. Its initial target is 1.3575, and then 1.3530, respectively.

Note: The level of risk may be high today.

| S1: 1.3630 | R1: 1.3720 |

| S2: 1.3575 | R2: 1.3765 |

| S3: 1.3530 | R3: 1.3820 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations