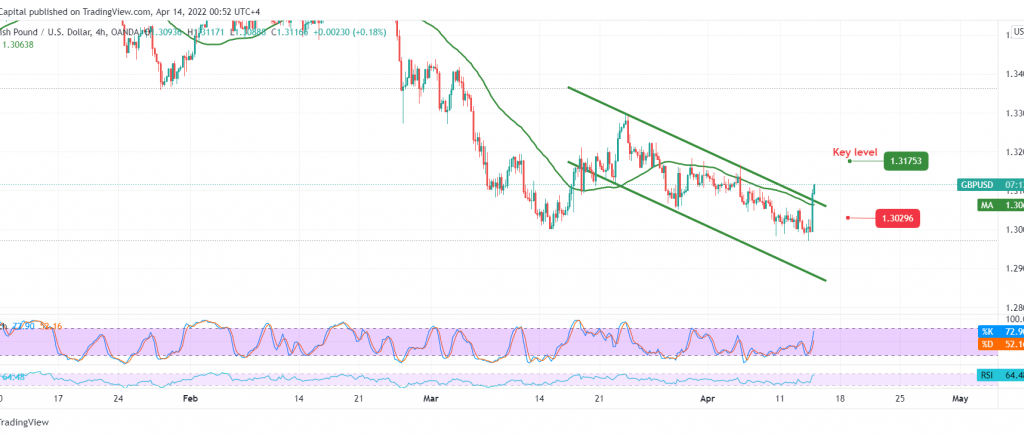

The British pound jumped to the top, achieving noticeable increases after touching the target mentioned in the previous analysis at 1.2975, recording its lowest level at 1.2972, which forced the pair to rebound to the upside again.

Technically, by looking at the 4-hour chart, we find the 50-day simple moving average, which returned to hold the price from below, in addition to the pair’s success in breaching the resistance level of 1.3085, settling above it for the moment.

There is a possibility to continue rising to retest the 1.3175/1.3165 level, and we should pay close attention in case the mentioned levels are touched due to the extent of their importance to the general trend in the short term. Its breach increases the strength of the bullish bias to head the price towards 1.3220.

The decline below 1.3040 and, most importantly, 1.3020 can stop the suggested scenario completely and renew the chances of negative pressure waiting for 1.2975 and 1.2930 next waiting station.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3020 | R1: 1.3175 |

| S2: 1.2925 | R2: 1.3220 |

| S3: 1.2875 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations