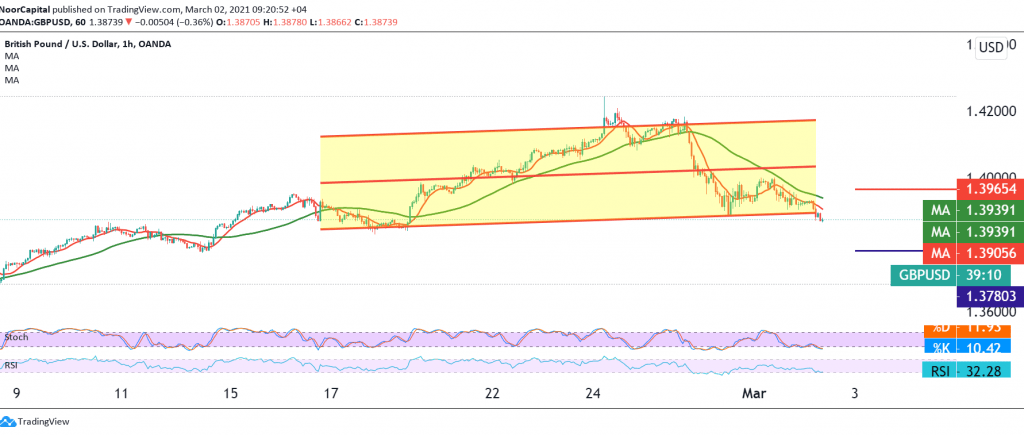

The resistance levels published in the previous analysis located at 1.4000 managed to curb the bullish bias of the British pound against the US dollar, which forced it to trade negatively again.

On the technical side, today there are clear negative signs coming from the RSI on short time frames, accompanied with the negative pressure on the pair from the 50-day moving average.

Therefore, we will maintain our negative expectations targeting 1.3825/1.3820 as the first target, bearing in mind that breaking the latter increases and accelerates the strength of the bearish trend, opening the way directly towards 1.3780.

The activation of the suggested scenario depends on the intraday trading remaining below 1.3960.

| S1: 1.3825 | R1: 1.3965 |

| S2: 1.3780 | R2: 1.4050 |

| S3: 1.3690 | R3: 1.4095 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations