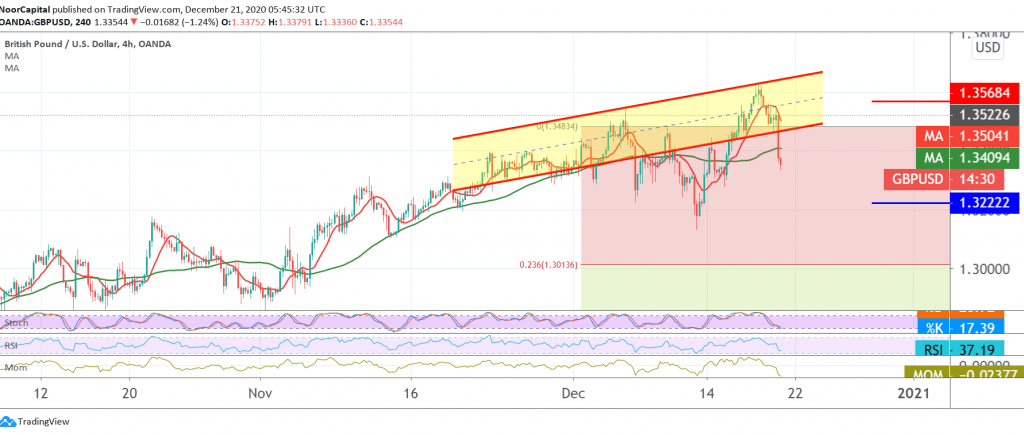

Strong negative movements dominated the trading of the pound sterling against the US dollar, as we expected during the previous analysis to start its weekly trading on a decline heading to visit our awaited target 1.3420, recording its lowest price during early trading for the current session 1.3336.

On the technical side, the RSI indicator on the negative side and bullish momentum is a factor that supports the continuation of the decline, as we find the 50-day moving average pressuring the price from the top.

From here, trading steadily below the previously breached support level, now converted to the 1.3420 resistance level, and the most important 1.3470, the bearish bias is likely today, targeting 1.3290 as a first target, and then 1.3210.

Trading again above 1.3470 is able to negate the expected bearish scenario and lead the pair to the upside path again, with an initial target of 1.3570.

Warning: The level of risk is high.

| S1: 1.3290 | R1: 1.3475 |

| S2: 1.3210 | R2: 1.3590 |

| S3: 1.3100 | R3: 1.3660 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations