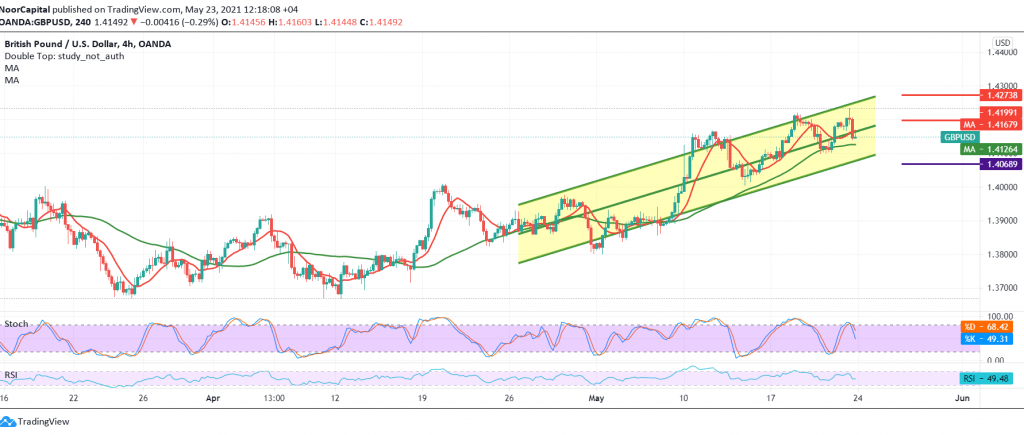

The British pound failed to surpass the pivotal resistance published last Friday, located at 1.4230, which we mentioned is an important and essential condition for the continuation of the pair’s rise against the US dollar, which forced it to trade negatively again.

Technically, today, it indicates the possibility that we will witness a bearish tendency in the coming hours, depending on the clear negative signs on the stochastic, in addition to trading stability below the psychological zone of 1.4200 resistance.

The bearish bias is likely today, targeting 1.4120/1.4100, bearing in mind that breaking the last extends the pair’s losses with a target of 1.4070.

From the top, surpassing the upside and rising again above 1.4210 is capable of aborting the bearish scenario and leading the pair to the official bullish path, so we are waiting for 1.4275, and its gains may extend later towards 1.4300.

| S1: 1.4115 | R1: 1.4210 |

| S2: 1.4070 | R2: 1.4270 |

| S3: 1.4020 | R3: 1.4305 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations