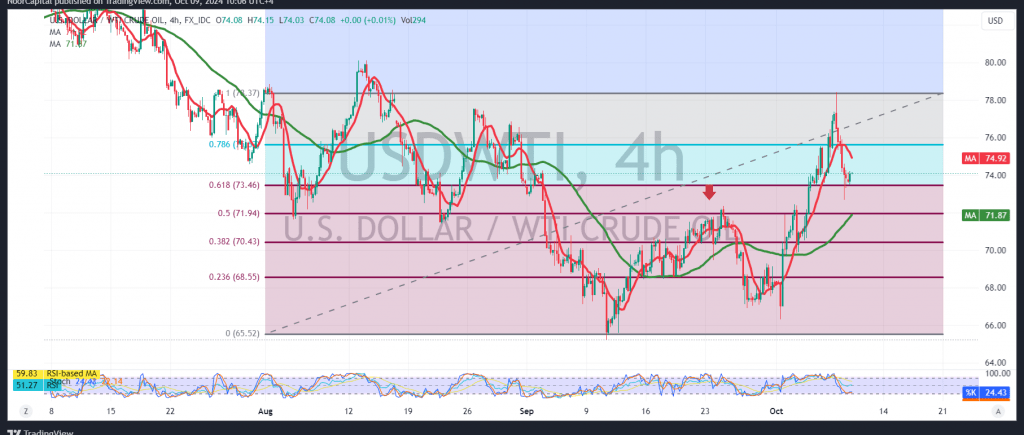

US crude oil futures experienced mixed, but mostly negative, trading after encountering strong resistance around the $78.40 level, which led to a pullback.

From a technical perspective, we lean toward a bearish outlook, but with caution, as the Stochastic indicator on the 4-hour chart signals a loss of upward momentum.

A confirmed move below the $73.45 support level, corresponding to the 61.80% Fibonacci retracement, could establish a bearish intraday trend, with a target of $71.90 at the 50.0% Fibonacci retracement.

Conversely, if prices break above the $74.80 resistance level, this would invalidate the bearish outlook, potentially resuming the upward trend with targets starting at $77.45.

Warning: The risk level is high.

Alert: The release of key economic data, including the “Federal Reserve Committee meeting results,” may result in significant price volatility.

Risk Reminder: The current geopolitical climate adds uncertainty, making a wide range of outcomes possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations