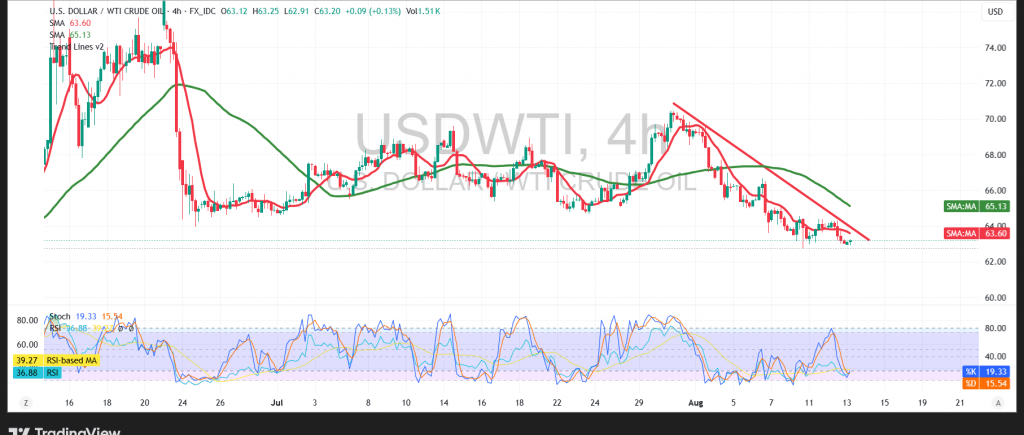

In our previous report, we maintained a bearish outlook, and US WTI crude oil futures extended their decline, recording a low of $62.97 per barrel.

Technical Outlook – 4-hour timeframe:

Selling pressure remains strong as prices continue to trade below the simple moving averages, which serve as a firm barrier to any recovery attempts. This is further reinforced by movement along a sharp descending trend line and the weakening momentum on the Relative Strength Index (RSI), confirming the sustained control of sellers.

Probable Scenario:

As long as the price holds below the $63.70 resistance and, more broadly, under the $64.00 psychological barrier, the bearish trend remains favored, with 62.70 as the initial target. A break below this level could accelerate losses toward the next support at 62.15. Conversely, a daily close above $64.00 may trigger a short-term recovery, paving the way for a retest of $64.85, followed by $65.35 as subsequent resistance.

Warning: Risks remain elevated amid persistent trade and geopolitical tensions, and all scenarios should be considered.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations