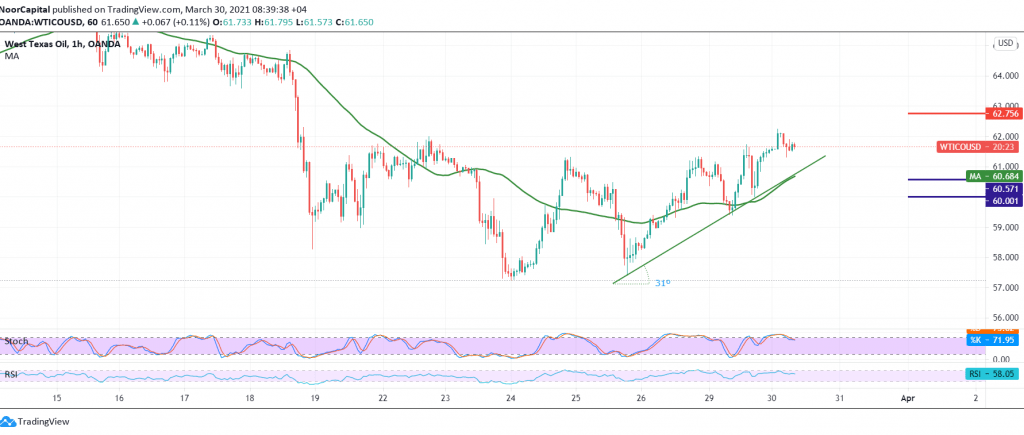

US crude oil futures prices were able to benefit from the psychological barrier support of 60.00, to return to the bullish rebound, surpassing the 61.30 resistance level, which we previously mentioned as the key to protecting the downside.

Technically, intraday trading has stabilized above 60.60 and in general above 60.00, accompanied by positive signs coming from the RSI and its stability above the middle line, in addition to the return of the 50-day moving average to hold the price from the top.

This increases the possibility that we will witness a bullish bias in the coming hours, targeting 62.75, and a breach of it extends oil’s gains, opening the way directly towards 63.50.

A reminder that breaking 60.00 and stabilizing below it will lead oil to the official bearish path again, with the initial target of 58.20.

Note: Risk may be high.

| S1: 59.90 | R1: 62.75 |

| S2: 58.25 | R2: 63.90 |

| S3: 57.10 | R3: 65.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations