The landscape of US crude oil futures contracts witnessed a blend of movements, oscillating between upward and downward trajectories in yesterday’s trading session. Notably, a robust support level near $76.40 acted as a formidable barrier, curtailing downward pressure and steering prices to a close near the $78.00 mark.

Technical Analysis Insights

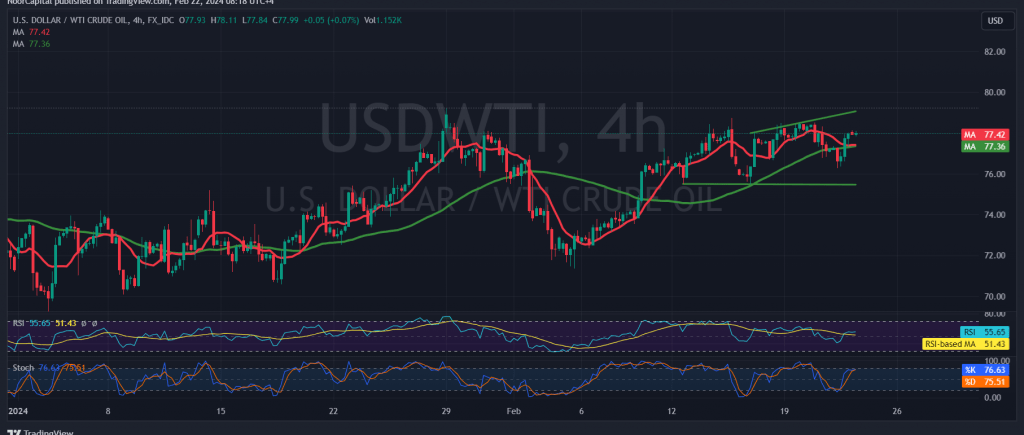

A meticulous examination of the 4-hour chart unveils compelling technical dynamics. Simple moving averages resurge from below, with the 50-day average converging around the $77.20 support level, augmenting its resilience. Concurrently, the 14-day Momentum indicator endeavors to garner positive signals, hinting at underlying strength in the market.

Cautious Optimism

While optimism prevails, it’s accompanied by a sense of caution. Intriguingly, maintaining stability in intraday trading above $77.00, particularly above $76.85, sets the stage for a bullish outlook. Initial targets loom around $78.60, with a breakthrough serving as a catalyst for further ascent towards $79.30. Beyond, aspirations extend to $80.00 as potential gains beckon.

Potential Downside Risks

However, vigilance remains imperative. A dip below $76.85 has the potential to disrupt the anticipated bullish trajectory, subjecting oil prices to temporary downward pressure, with a retracement towards $75.70 becoming plausible.

Indicators and Cautionary Notes

The Stochastic indicator endeavors to shed prevailing negative signals, implying possible price fluctuations until a definitive market direction is established.

Economic Data Alert

Market participants brace for the release of high-impact economic data. Foremost among these are the preliminary readings of the services and manufacturing PMI indices from France, Germany, and the United Kingdom. Additionally, attention is riveted on updates concerning unemployment benefits and the preliminary reading of the purchasing index for both the services and manufacturing sectors from the United States. Anticipate heightened volatility during these news releases.

Risk Advisory

Amidst ongoing geopolitical tensions, the risk landscape remains elevated, potentially fostering heightened price volatility. Traders are urged to exercise caution and adopt robust risk management strategies to navigate these uncertain waters effectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations