Crude oil prices experienced mixed trading with a positive tendency, reaching a peak at $72.45 per barrel amidst ongoing geopolitical tensions.

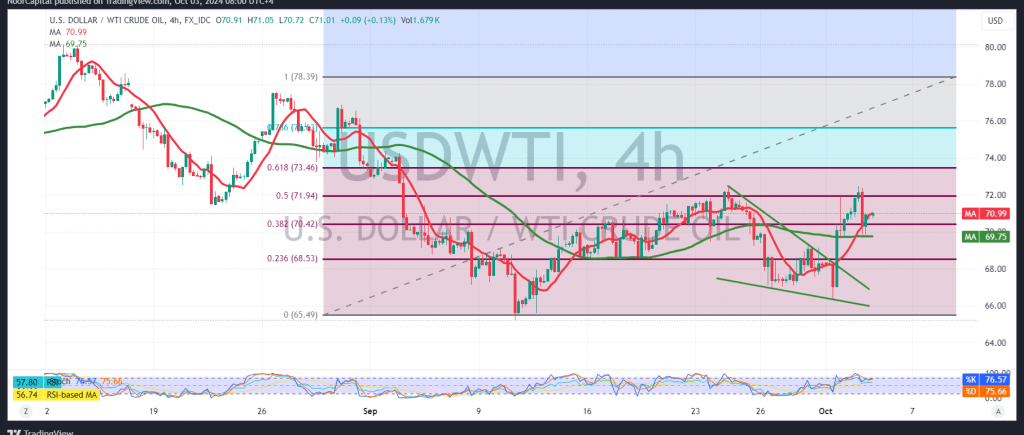

Technically, the outlook remains cautiously optimistic, with oil prices continuing to receive positive momentum from the 50-day simple moving average. This is supported by stable intraday trading above the key 70.40 support level, which aligns with the 38.20% Fibonacci retracement.

There is a potential for the upward trend to resume, with $72.45 as the first target. A confirmed breach of this level could act as a catalyst, accelerating the upward momentum toward the next official target at $73.65.

On the downside, a return to stable trading below the 70.40 level would place oil under strong negative pressure, likely leading to a session in negative territory, with an initial target of $69.80.

Warning: The risk level remains high.

Alert: Today we expect high-impact US economic data, including “Unemployment Benefits” and “ISM Services PMI,” which could lead to significant price volatility.

Risk Warning: Ongoing geopolitical tensions elevate the risk level, and all scenarios remain possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations