US crude oil futures prices managed to touch our published target in the previous analysis, located at 59.00, recording a low of 59.08.

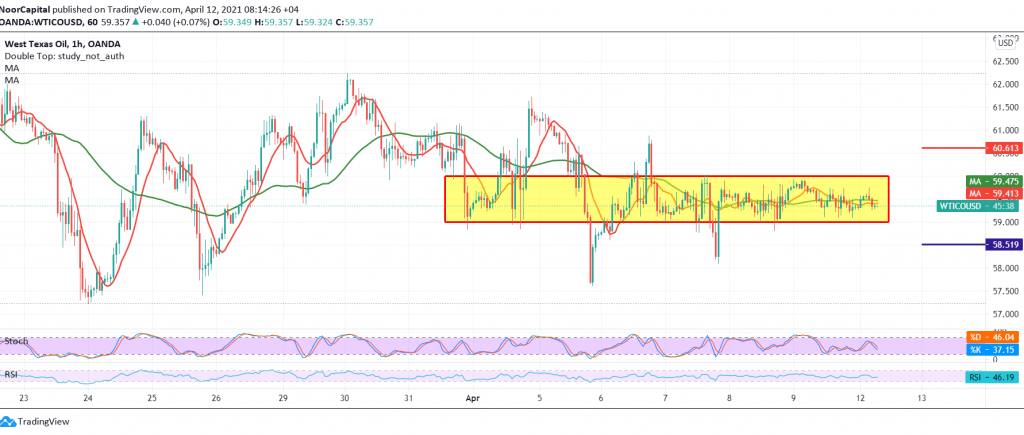

Technically, we find the price of oil is trying to build a base on the support floor of the psychological barrier 59.00, and on the other hand, we find the 50-day moving average pressuring the price from the top.

With the trading range receding from the bottom above 59.00/58.80 and from above below 60.10, we will stand on the fence until we release the aforementioned range, in order to get a more accurate indication, so that we are in front of one of the following scenarios:

Activation of short positions requires breaking 59.00/58.80, which facilitates the task required to visit 58.35, and then 58.00 next stop.

Activating long positions depends on witnessing a clear and strong breach of the resistance level of 60.00/60.10, which strengthens the chances of an upside move towards 60.50 and then 61.00, respectively.

| S1: 59.00 | R1: 59.70 |

| S2: 58.35 | R2: 60.10 |

| S3: 57.90 | R3: 60.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations