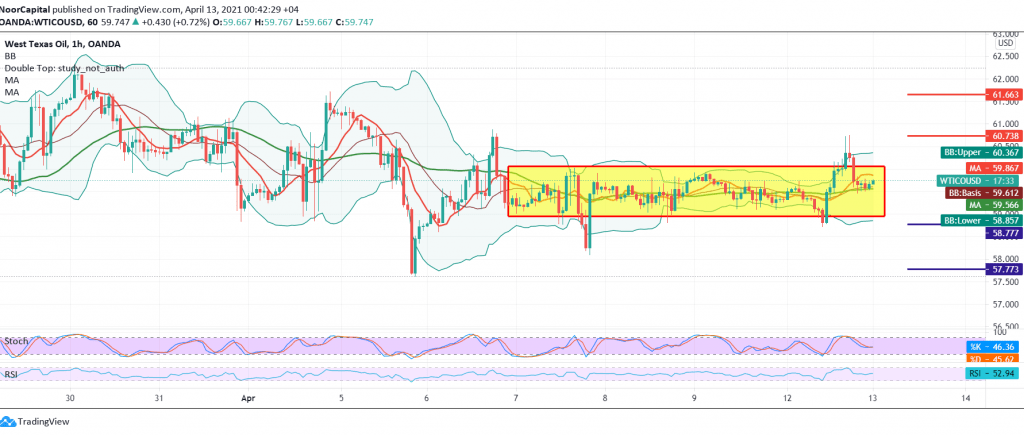

Divergent trades dominated the futures movement of US crude oil during the previous trading session. To remind us, we have remained neutral, awaiting the activation of pending orders, indicating that the confirmation of the breach of 60.00/60.10 strengthens the chances of a rally towards 60.50 to reach its highest level at 60.75.

Technically, the current moves are stabilizing again below the psychological barrier of 60.00 and are still stable from the top above 59.00. With a closer look at the moving average chart, the price is pressing from above, in addition to the negative signals coming from the RSI.

Although we tend to be negative, we prefer to break free from the sideways range in order to obtain a high quality deal, as we are facing one of the following scenarios:

A break of 59.00 puts the price under negative pressure, targeting 58.70 and then 57.70, respectively. Skipping above the psychological barrier of 60.00 increases the probability of touching 60.75 and 61.70 respectively.

| S1: 58.70 | R1: 60.75 |

| S2: 57.70 | R2: 61.70 |

| S3: 56.65 | R3: 60.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations