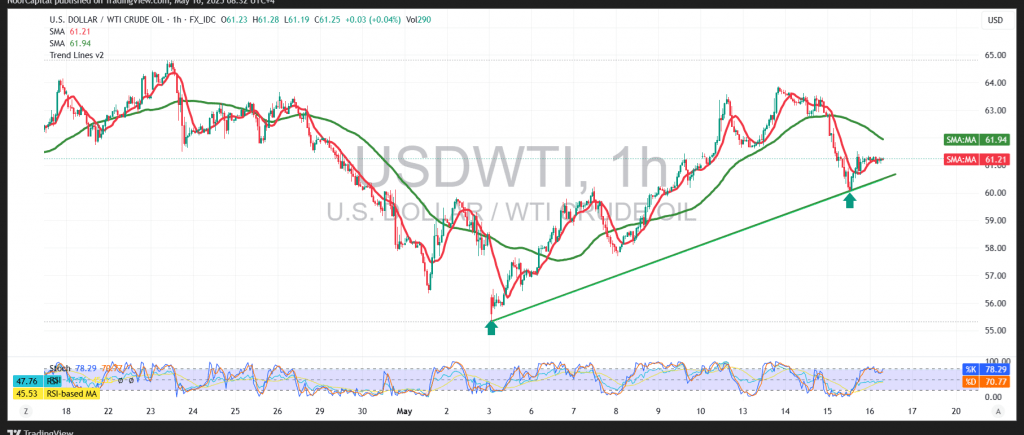

U.S. crude oil futures aligned with the expected upward movement in the previous session, as the price held above the pivotal $61.20 support level. Although the market briefly dipped to $60.11, triggering a pullback that offset earlier long positions, the broader technical structure remains constructive.

On the 4-hour chart, the price continues to test and attempt stabilization above the key $61.20 level, which remains a critical pivot for today’s trading. The 50-period simple moving average is reinforcing this support zone, helping to maintain bullish momentum. Additionally, the Relative Strength Index (RSI) is trending positively, supporting the case for a further upside.

While technical indicators are increasingly favorable, we prefer a cautious approach—waiting for continued stability above $61.20 to confirm the upside scenario. If confirmed, this could lead to a retest of the $62.10 and $62.70 resistance levels, with potential for an extended move toward $64.00.

However, a failure to consolidate above $61.20 would weaken bullish momentum and expose crude oil to short-term downside pressure, with potential retracement toward lower support zones.

Risk Disclaimer:

Amid ongoing global trade tensions and elevated macroeconomic uncertainty, risk levels remain high. Traders should stay alert and be prepared for increased volatility and multiple market scenarios.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations