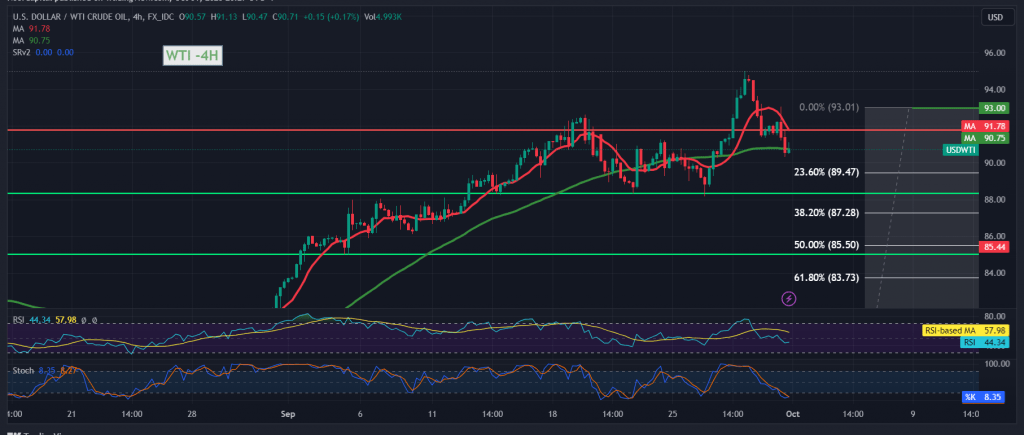

US crude oil futures prices achieved the bearish correction targets published during the previous technical report at 90.45, recording its lowest level at $90.40 per barrel.

Technically, oil prices are pressing on the strong support floor 90.40, accompanied by continued negative pressure from the 50-day simple moving average and signs of declining momentum coming from the 14-day momentum indicator on short intervals.

Therefore, there is a possibility of a bearish bias during today’s trading session, targeting 89.40, the 23.60% correction, considering that confirmation of breaking the level above may force oil prices to continue the bearish correction towards 88.70.

Only from above, the jump to the upside and the price consolidation above the strong resistance 92.40 and most importantly 92.75 will immediately stop the proposed bearish scenario, and oil will recover with a target of 93.20 and 94.00.

Note: Today we are awaiting high-impact economic data issued by the US economy, the Manufacturing Purchasing Managers’ Index, and the speech of Federal Reserve Chairman Jerome Powell, and we may witness high price fluctuations at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations