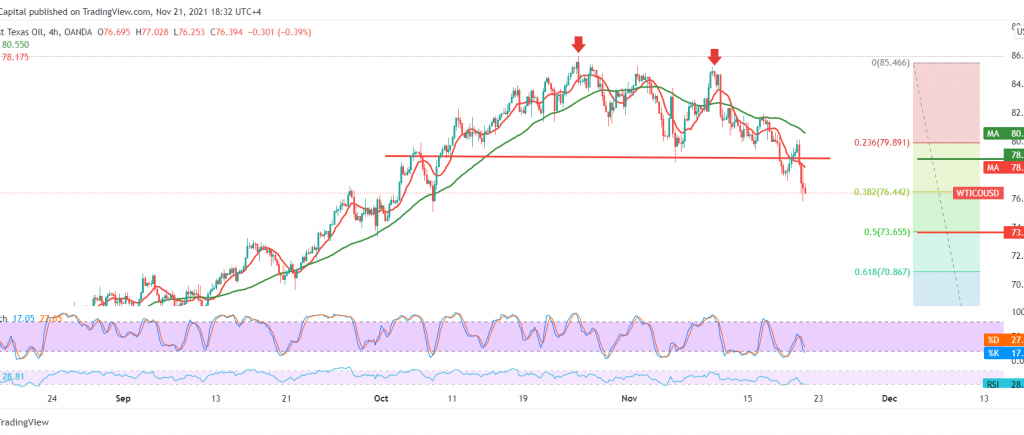

US crude oil futures prices witnessed a noticeable decline in the red zone, surpassing our target of 76.45 and reaching the lowest level at 75.10.

Technically, activating the bearish scenario is still intact, with the decline accelerating due to gaining strong bearish momentum signals, coinciding with the short-term moving average surpassing the long-term moving average.

Therefore, we maintain our negative expectation to target the price point around 74.10, a first target, and losses may extend to 73.65.

Trading below the previously broken support-into-resistance level at 78.30 is essential for maintaining the bearish bias, and breaching the mentioned level will immediately stop the bearish scenario suggested above. As a result, the oil will recover with a target of 80.90.

Note: The risk level is high.

| S1: 74.10 | R1: 78.35 |

| S2: 72.50 | R2: 80.90 |

| S3: 69.80 | R3: 82.55 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations