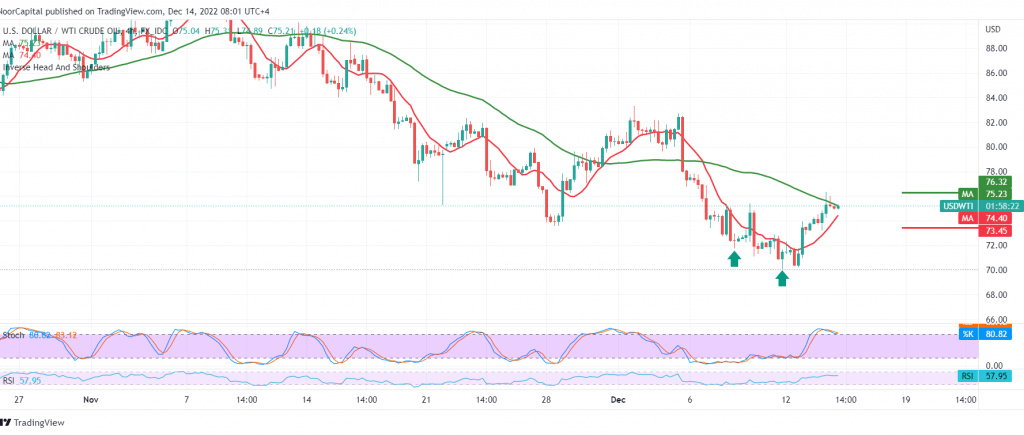

crude oil futures prices achived strong gains within the expected bullish path during the previous analysis, touching the retest target 75.30, surpassing the required target, and recording a high of 76.35.

On the technical side today, and with a closer look at the 4-hour chart, we find that stochastic started to lose bullish momentum due to overbought conditions, and the simple moving average is trying to pressure the price from above.

We may witness a bearish slope in the coming hours, aiming to retest 73.60 before starting the rise again, taking into consideration that the bearish slope does not contradict the bullish trend, whose official targets are located around 76.65 & 77.40 once it consolidates above 76.30.

Note: Today we are awaiting high-impact economic data from the United States of America, and we may witness high volatility:

Fed interest rates

Fed statement

Fed press conference

Economic forecasts

Note: Trading on CFDs involves risks and therefore scenarios may be possible. What was explained above is not a recommendation to buy or sell, but rather an illustrative reading of the price movement on the chart.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations