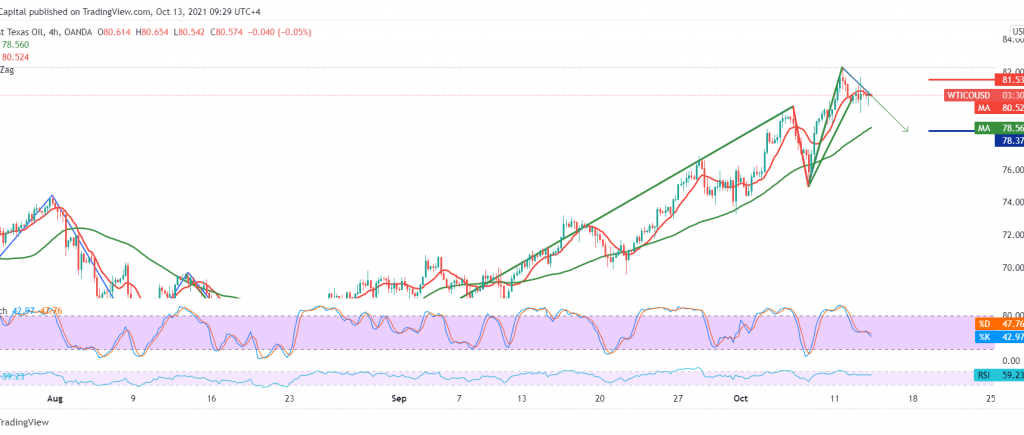

American crude oil prices succeeded in achieving the bearish correction, touching the first corrective target located at 79.55, recording its lowest level during the previous session, 79.45.

Technically, and with careful consideration on the 4-hour chart, we notice that the RSI continues to defend the bearish correction, in addition to the stability of trading below the pivotal extended resistance level 81.50/81.20.

Therefore, the bearish correction tendency remains valid and effective, targeting 79.45, knowing that breaking it will extend oil losses so that we will be waiting for the second target, 78.40.

To remind you that the return of stability above 81.50 will immediately stop the above-suggested scenario and lead oil prices to complete the official bullish trend with a target of 82.65. Note: The risk level may be high.

| S1: 79.45 | R1: 81.50 |

| S2: 78.35 | R2: 82.65 |

| S3: 77.35 | R3: 83.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations