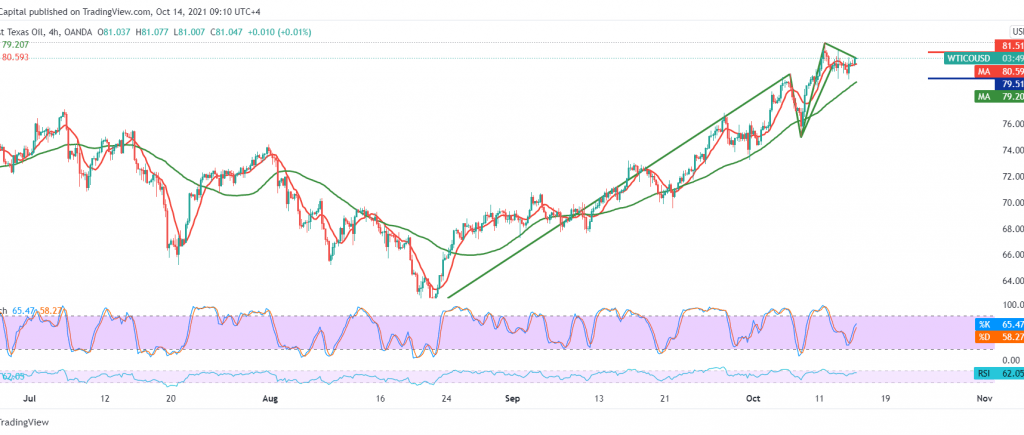

US crude oil futures prices are trying to build on the solid support floor at 79.45, which forced oil to rebound, stable around 81.00 during the early trading of the current session.

Technically, we tend to the negativity, relying on the stability of trading below the pivotal resistance level around 81.55/81.50, accompanied by the oil getting negative signals from the RSI over the short time intervals, which supports the possibility of a bearish correction in the coming hours, on the other side the positive motive coming from the average The 50-day simple moving average, which returned to hold the price from below, supports the bullish price curve.

With the conflicting technical signals and the high level of risks, we prefer to stand aside until the daily trend becomes clearer more accurately, waiting for one of the following scenarios:

Activating long positions depends on confirming the breach of 81.55, which extends the gains of oil, stops the bearish correction and leads the price to touch 82.15 and 82.80.

Activating short positions requires stability below 79.80, and most importantly, 79.45, and from here, we are witnessing oil prices being subjected to selling pressures, with targets starting at 78.80 and extending to 78.30.

| S1: 79.85 | R1: 81.50 |

| S2: 78.80 | R2: 82.15 |

| S3: 78.30 | R3: 83.20 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations