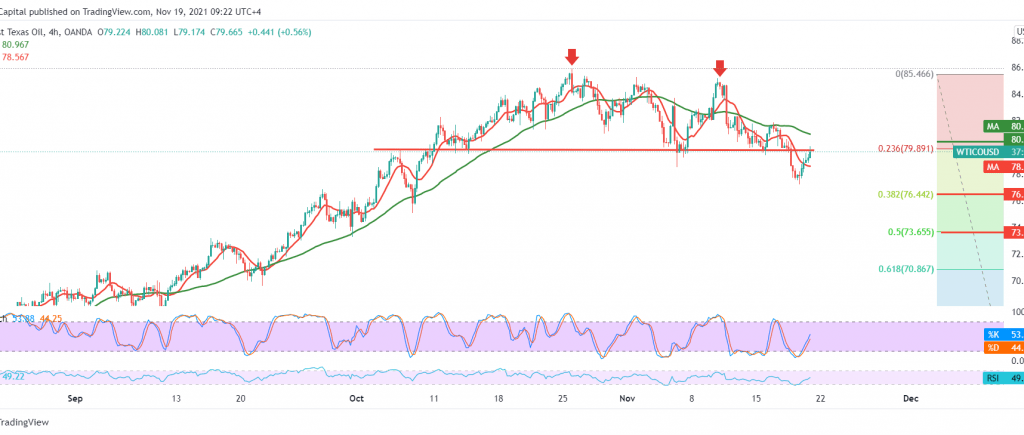

US crude oil futures prices incurred significant losses within the expected negative outlook during the last technical report, exceeding the required official target of 77.40, heading to the mentioned price station 76.45, recording its lowest level at 76.44.

Technically, the current movements are witnessing an upward bias as a result of hitting the strong support barrier at 76.45, the 38.20% Fibonacci correction as shown on the chart, in addition to the positive crossover signs that started appearing on the stochastic indicator.

Therefore, we may witness rises in the coming hours to retest the 80.00 level before declining again.

Note: the temporary bullish bias does not contradict the bearish trend, which targets around 73.65, 50.0% correction, as soon as we witness a break below the support level 46.45. Note: The level of risk is high.

| S1: 77.15 | R1: 80.00 |

| S2: 75.35 | R2: 81.10 |

| S3: 74.30 | R3: 82.85 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations