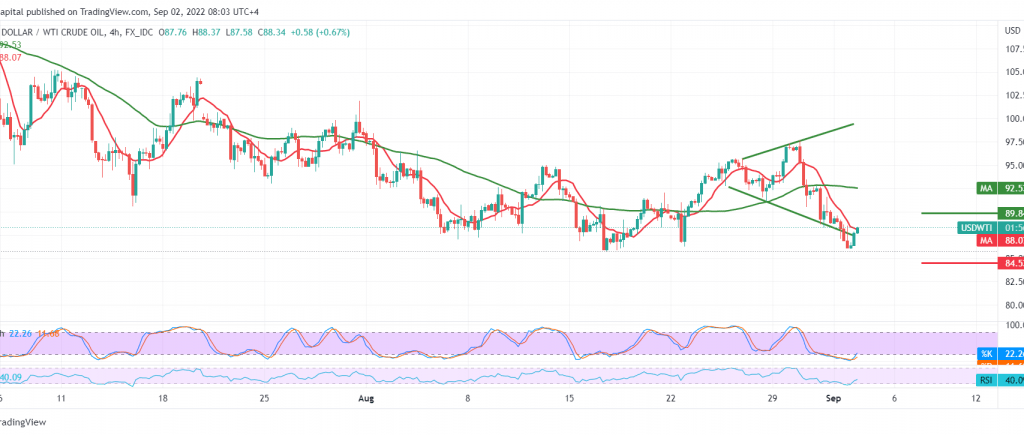

US crude oil futures prices could continue achieving the bearish targets as we expected, bypassing the official price target station of 86.50 to record the lowest level at 85.97.

On the technical side, the current movements are witnessing a bullish trend, as a result of the price gaining positive momentum on the 60-minute time frame, which may support a temporary bullish bias, in addition to stabilizing the intraday trading above the 87.00 support level.

Therefore, the possibility that we will witness a bullish bias in the coming hours may be possible with the aim of retesting 89.10, a first target, knowing that consolidation above the mentioned level may extend intraday gains towards 89.80 before resuming the decline again.

Note: the bullish bias does not contradict the general bearish trend, whose initial targets are at 84.50 in case oil fails to maintain trading above 86.40.

Note: The US NFP, unemployment rate data and average wages are due for release today in the USA, and they have a big impact, and we may see price fluctuations; all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations