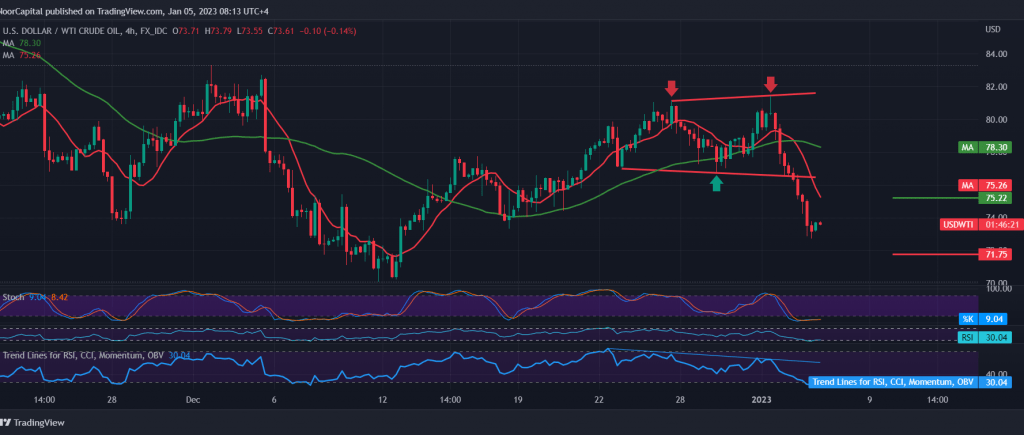

As we expected during the previous technical report, big losses were incurred by the prices of US crude oil futures contracts, touching the official target to be achieved at 73.40, recording its lowest trading for yesterday’s session at 72.80.

Technically, with the continuation of the negative pressure coming from the simple moving averages, the continuation of the decline in momentum, and the bearish technical formation shown on the chart.

Therefore, resuming the bearish daily trend may be the most preferable, knowing that the decline below 72.80 facilitates the task required to visit 71.80 as the first target, the losses may extend later to visit 71.00.

Only from above, trading stability returns above the previously broken support, which has now turned into a resistance level at 75.30, capable of postponing the suggested bearish scenario and leading oil prices to recover temporarily towards a retest of 76.70.

Note: Today we are awaiting the report issued by the International Energy Agency regarding oil stocks, and we may witness high fluctuations in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations