US crude oil futures prices jumped, achieving noticeable gains as expected, exceeding the official target required to be achieved at 86.30 to record the highest level of $86.95 per barrel.

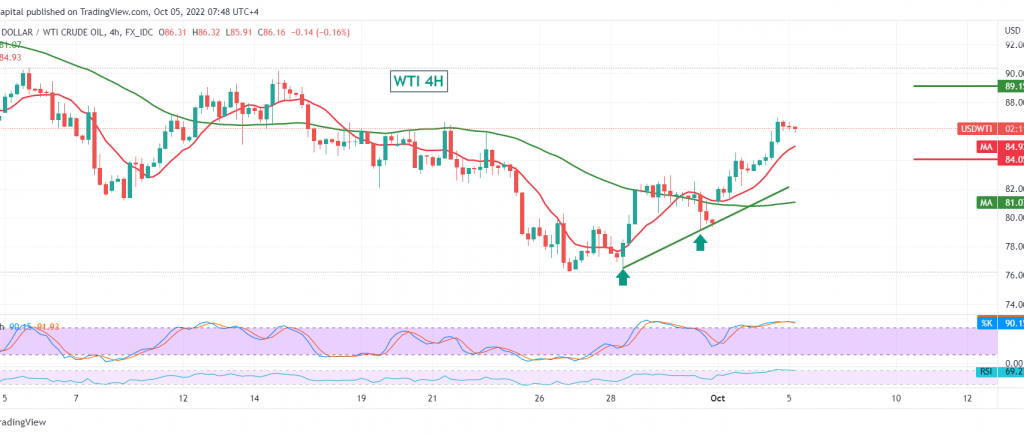

Technically and carefully looking at the 240-minute chart, we find that the 50-day simple moving average continues to hold the price from below, in addition to stabilizing intraday trading above the 84.00 support level.

Therefore, the possibility of the rise is still valid and effective, provided we witness a consolidation of the price above 87.00. This motivating factor enhances the chances of touching 87.65, the first target. The upside targets may extend to visit 89.10 if the price is stable above 84.00.

Note: Today, we are waiting for the OPEC meeting to determine the production cut, in addition to the report issued by the International Energy Agency on oil stocks, and we may witness high price volatility.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations