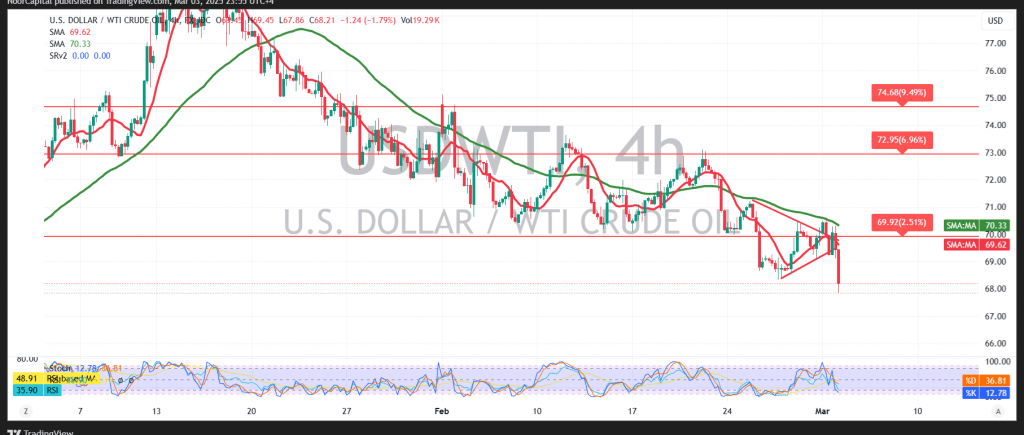

U.S. crude oil futures experienced a sharp decline, aligning with our previous technical outlook, reaching the first target at $68.85 and coming within a few points of the next official support at $67.80, recording a low of $67.85 per barrel.

Technical Outlook

A closer look at the 4-hour chart shows that the Relative Strength Index (RSI) continues to reinforce the bearish trend, further supported by a negative crossover in the simple moving averages, which continue to exert downward pressure on prices.

Expected Scenarios

- Bearish Scenario: A confirmed break below $67.90 is likely to accelerate the downward momentum, opening the way toward $67.10, with potential losses extending further to $66.30.

- Bullish Scenario: A return to stability above $69.70 could temporarily halt the bearish outlook, leading to a short-term recovery attempt toward $70.50 as an initial upside target.

Risk Warning: Market conditions remain highly volatile amid ongoing trade tensions, and multiple scenarios remain possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations