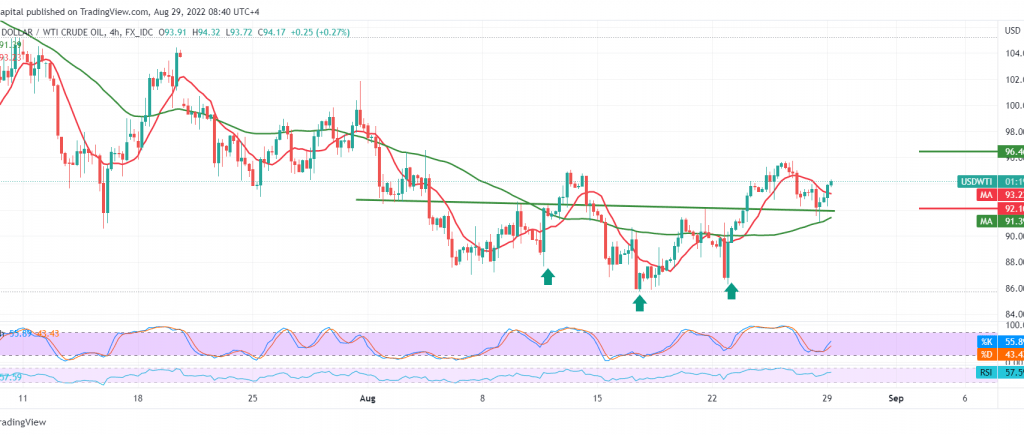

US crude oil futures prices managed to retest the target mentioned in the previous analysis, surpassing the required target at 91.80, recording its lowest level at 91.10.

Technically, prices returned to the bullish rebound once again, building on support level of 92.00 and supported by the positive motive coming from the simple moving averages that continue to hold the price from below, coinciding with the positive momentum signs on the short time intervals.

Therefore, the idea of resuming the rise is still valid and effective, knowing that consolidation above 94.30 is a catalyst that paves the way for oil prices to achieve gains that start at 95.30 and extend to visit 96.40 as long as the price is stable above 92.00.

It should be noted that the failure of oil prices to maintain trading above 92.00 is leading the price to enter a bearish corrective wave with its initial target of 90.00.

Note: The risk level is high, all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations