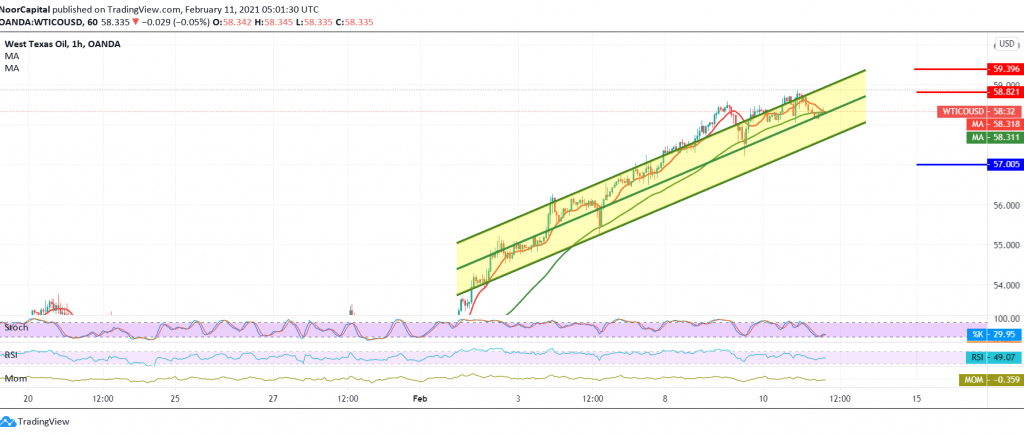

Positive trading dominated the futures price of US crude oil, touching our first awaited target during the previous report at 58.60, to record its highest level at 58.80.

Technically, the oil found a strong resistance level around 58.80, where the current moves are witnessing a bearish slope. With a closer look at the chart, we find a conflict between the positive motive of the 50-day moving average that continues to hold the price from below and supports the return of the rise, and between the negative features that began to appear on the stochastic indicator.

We will stand aside for the moment until the picture becomes clearer more accurately, to be in front of one of the following scenarios: The continuation of the rise depends on the intraday trading stability above the psychological barrier of 58.00. We also need to witness the breach of 58.80 to push the price to visit 59.30 then 59.70.

Activating short positions requires confirmation of the 58.00 break, which puts the price under temporary negative pressure, targeting 57.10 / 57.00.

| S1: 57.95 | R1: 58.80 |

| S2: 57.50 | R2: 59.30 |

| S3: 57.05 | R3: 59.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations