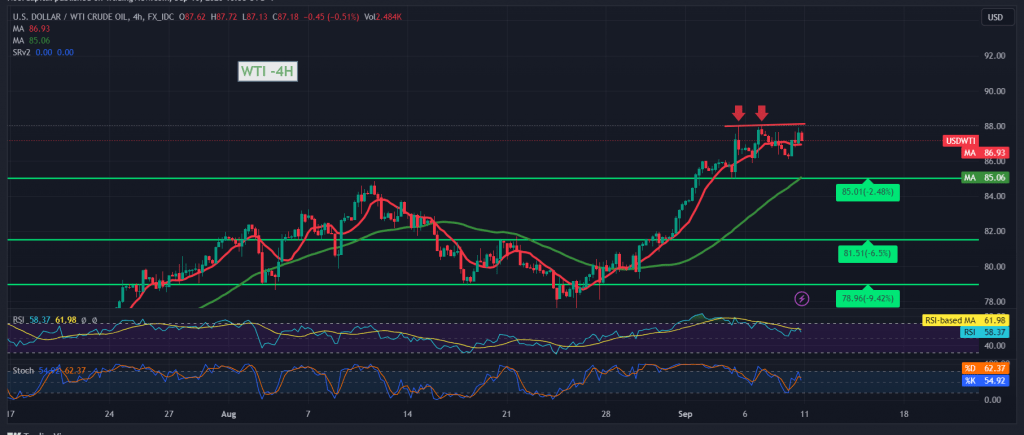

Mixed trading dominated the prices of US crude oil futures contracts, confined from the bottom above 86.20 and the top below the psychological barrier resistance level of 88.00.

Technically, with a closer look at the 4-hour chart, the Stochastic indicator began sending negative crossover signals, and this is accompanied by the stability of intraday trading below 87.50, and in general, below the resistance of the psychological barrier of 88.00.

We continue to favor the idea of a bearish correction, targeting 86.30 as the first target, and breaking it increases and accelerates the strength of the expected bearish correction, so we are waiting for 85.40.

From the top, it crosses upwards and the price consolidates above the pivotal resistance of 88.00. This leads oil prices to complete the official upward path, with targets starting at 88.80 and extending towards 89.70.

Note: the risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations