U.S. crude oil futures experienced a sharp drop yesterday, testing the psychological support level around $64.00 per barrel.

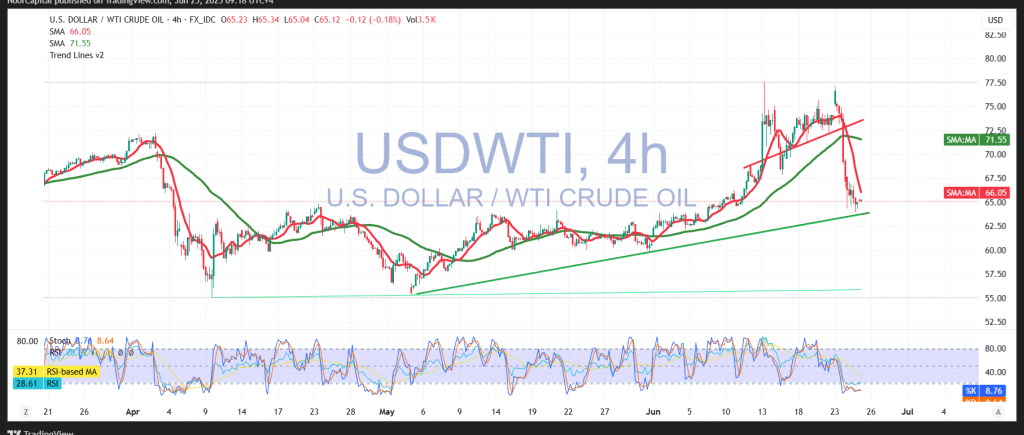

From a technical perspective, intraday price action shows a modest recovery, with prices currently trading slightly above $65.00. A review of the 4‑hour chart indicates that the simple moving averages remain positioned above current prices, forming dynamic resistance that may slow further gains. However, early signs of positive momentum are emerging in shorter‑term indicators.

Given this mix of signals, the market outlook hinges on price behavior near key levels:

- Bullish scenario: A breakout above the pivotal resistance zone at $65.25 could pave the way for initial gains toward $66.30. A confirmed move above $66.35 might trigger a stronger rally targeting $67.20.

- Bearish scenario: Conversely, a renewed break below $64.00 would reinforce the downtrend. In that case, further losses may target $63.60, extending toward $62.00.

Warning: All eyes remain on today’s release of U.S. economic data—including testimony from Federal Reserve Chairman Jerome Powell—which may inject high volatility into energy markets.

Warning: Elevated risk conditions persist amid ongoing global trade and geopolitical uncertainties; traders should be prepared for rapid shifts in market direction.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations