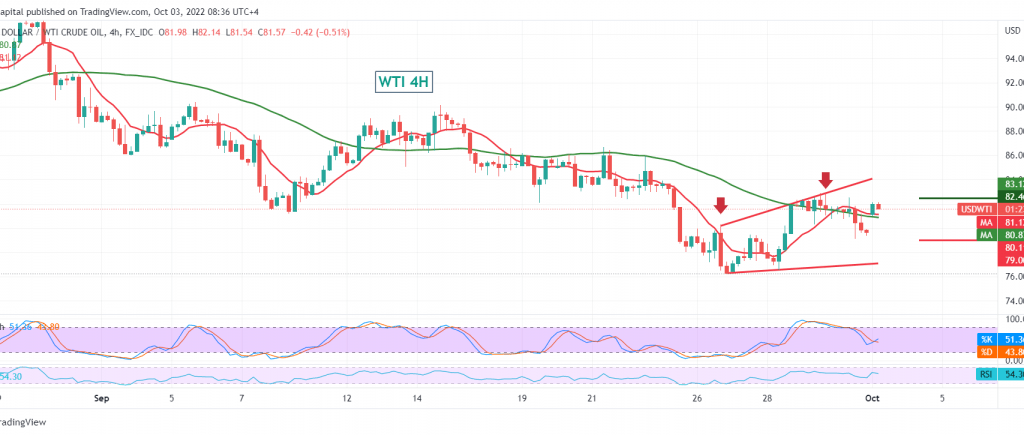

US crude oil futures prices opened their first weekly trading on a bullish price gap, recording a high of $81.65 per barrel.

Technically, the price starts pressure on the 50-day simple moving average, in addition to the clear negative features on stochastic on the 4-hour time frame.

We tend to be negative, but with caution, we are only waiting for confirmation of breaking 81.50, and that will facilitate the task required to resume the decline, targeting 79.60, a first target. It may extend later towards 79.00 initially.

To remind you, the stability of daily trading below 82.30 is an essential condition for the drop, and its breach may lead the price to achieve gains around the 83.00 area.

Note: the level of risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations