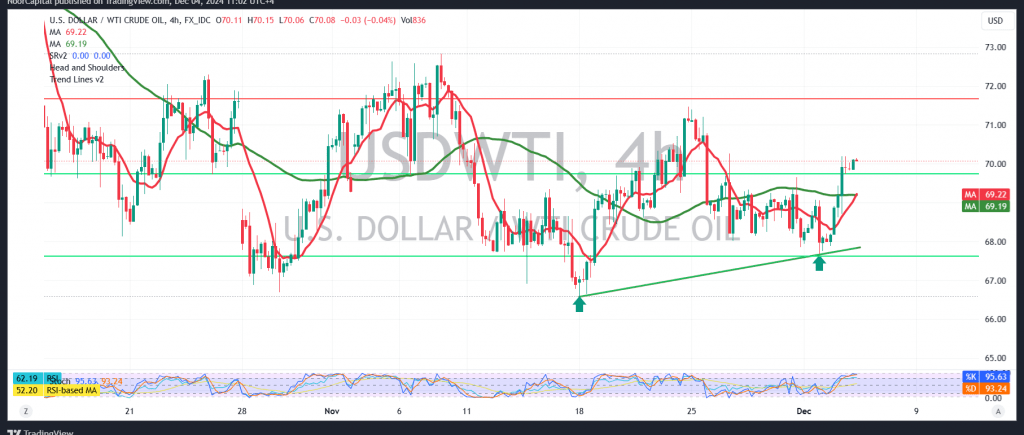

US crude oil futures displayed bullish attempts in the previous session, reaching a high of $70.20 per barrel.

From a technical perspective, the outlook remains positive, supported by the bullish crossover of simple moving averages that align with the daily upward trajectory. Furthermore, the price stability above the key support level of 68.90 reinforces the likelihood of continued upward movement.

Scenario Analysis:

- Bullish Case: With intraday stability above 69.50 and general stability above 68.90, the upward trend remains dominant. Initial targets are set at 70.90, and surpassing this level opens the way for gains toward 71.65.

- Bearish Case: Failure to maintain stability above 69.50 or a close below 68.90 on at least an hourly basis could reverse the trend. In such a scenario, the price may retreat to test 67.20 and further decline toward 66.40.

Warning: High-impact U.S. economic data, including “Non-Farm Private Sector Jobs Change,” “ISM Services PMI,” and a speech by Federal Reserve Chairman Jerome Powell, may trigger significant price volatility.

Warning: Amid persistent geopolitical tensions, the level of risk is elevated, and all scenarios remain plausible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations