US crude oil futures experienced mixed trading, attempting to pare losses after reaching a low of $67.78 per barrel.

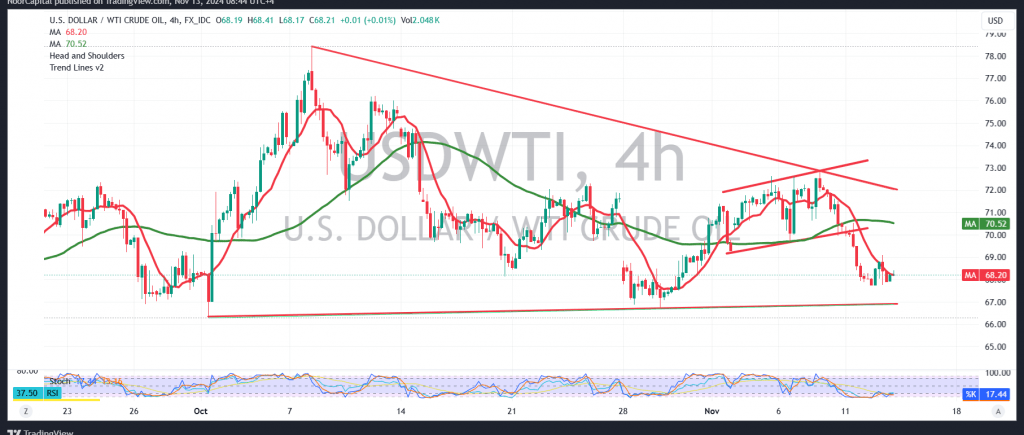

From a technical standpoint, oil prices remain under negative pressure, driven by continued movement below the simple moving averages. Additionally, the price is currently stabilizing below the key resistance level at $68.65.

As a result, a bearish outlook is still favored for today’s session, with an initial target of $67.65. Breaking below this level could intensify and accelerate the downtrend, paving the way for a move towards the next target of $67.00.

To validate this scenario, oil prices must stay below $68.65. However, should the price manage to close an hourly candle above this level, the bearish trend may be temporarily disrupted. In that case, we could see efforts to initiate a short-term upward correction, with targets set at $69.70 and $70.30.

Caution: The elevated risk level may not align with the potential returns.

Risk Alert: High-impact economic data from the US, specifically the “Consumer Price Index – Annual and Monthly,” is scheduled for release today. Significant price fluctuations may occur at the time of the announcement.

Geopolitical Risk Warning: Ongoing geopolitical tensions contribute to heightened market uncertainty, making a wide range of scenarios possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations