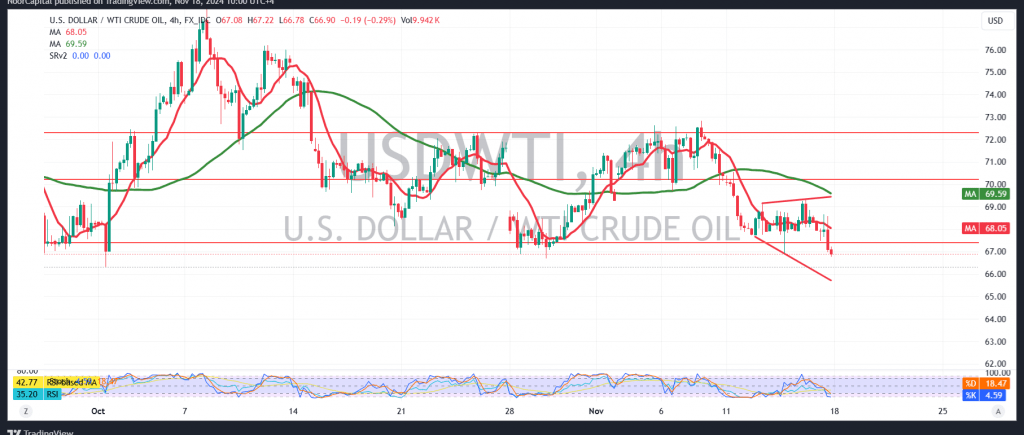

US crude oil futures experienced sharp declines at the start of the week, bottoming out at $66.84 per barrel.

From a technical standpoint, the 4-hour chart reveals that oil prices have decisively broken below the support level of $68.65. The persistent downward pressure from the simple moving averages continues to favor a bearish outlook, reinforcing the likelihood of a further decline.

Accordingly, the bearish scenario is expected to dominate, with $66.00 serving as the initial target. A breach of this level could lead to additional losses, with the next target being $65.20.

However, for this bearish outlook to remain valid, oil prices must hold below $68.65. If a candle closes at least one hour above this level, it could disrupt the downtrend, potentially triggering a short-term upward wave with initial targets at $70.20.

Warning: The risk level is elevated and may not align with the expected returns, demanding careful risk management.

Alert: Given the ongoing geopolitical tensions, market volatility is high, and multiple scenarios remain possible.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations