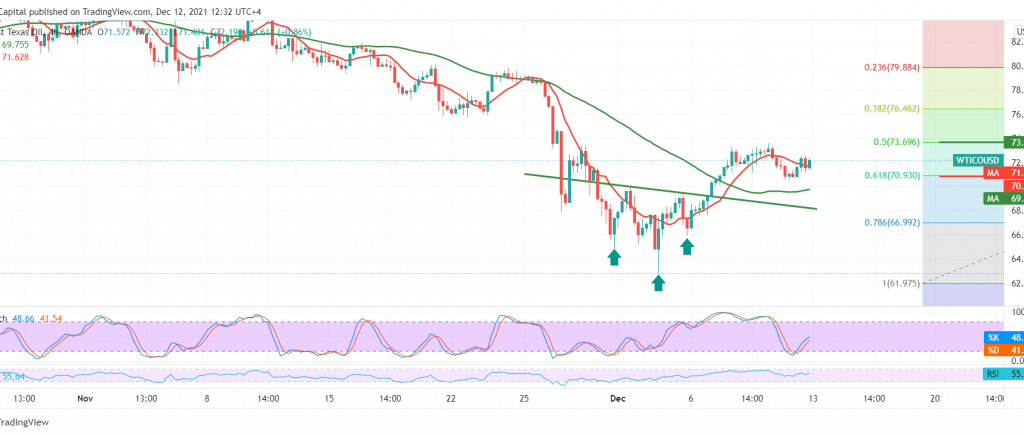

Mixed trading dominated the US crude oil futures prices to retest the strong support level of 70.30, recording its lowest level at 70.50, resuming the bullish rebound again.

Technically, by looking at the 60-minute chart, we notice the stability of the RSI above the mid-line 50, in conjunction with the attempts of the 50-day moving average to push to the upside.

With the price building above 70.90 represented by the 61.80% Fibonacci as shown on the chart, we may witness a bullish bias during today’s trading, targeting a retest of 72.60 first target, knowing that breaching it may extend the gains to 73.65, 50.0% correction.

Stability below 70.90 can thwart the mentioned scenario and witness a negative trading session, with its initial target around 69.70, while its official target is 69.10.

Note: The risk level is high.

| S1: 70.85 | R1: 72.60 |

| S2: 69.80 | R2: 73.35 |

| S3: 69.10 | R3: 74.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations