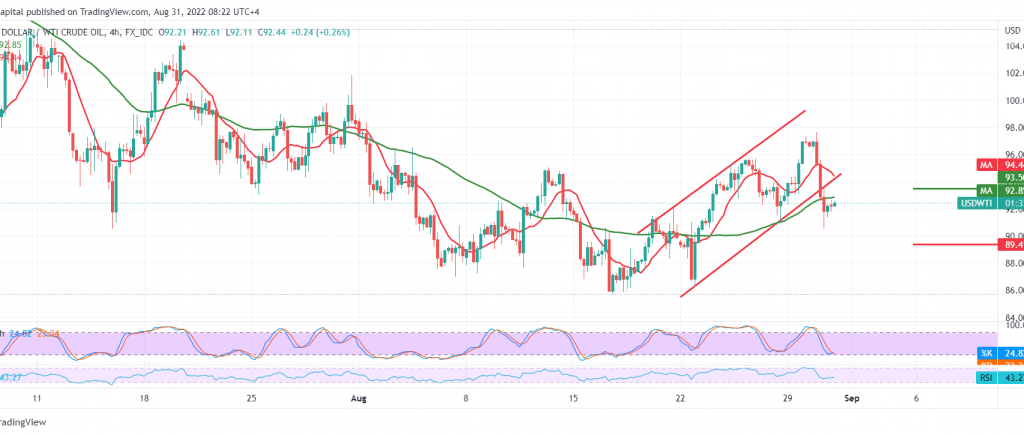

US crude oil futures prices reversed the expected bullish trend during the previous analysis, in which we depended on the stability of trading above the 94.70 support floor. Breaking 94.70 postpones the idea of the rise and puts the price under temporary negative pressure targeting 93.60, recording its lowest level at 90.50.

Technically, and carefully looking at the 60-minute chart, we find that the RSI started sending negative signals with the success of oil in breaking a major support level at 93.50.

Therefore, the chances of continuing the decline are valid during the current trading session, targeting 89.50, an official waiting station, unless we witness a new trading base above 93.50 because its breach leads the price to retest 94.50 before attempting to decline again.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations