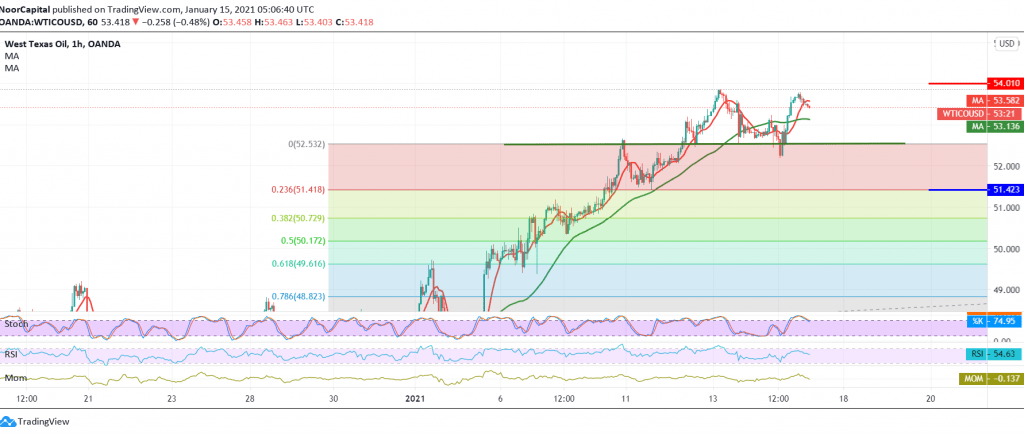

Negative trading dominated the futures price of US crude oil in the context of the downside correction expected yesterday, touching the target of the first correction published in the previous analysis at52.20, recording its lowest price of 52.20.

Technically, we find the aforementioned support level of 52.20 that was able to limit the bearish tendency to witness positive trading, targeting a retest of 53.10 and to settle above it.

Taking a look at the 60-minute chart, we find the RSI indicator is starting to get positive signals. From here, intraday trading remains above 53.10 and in general, above 52.50, the bullish bias is likely today targeting the extended resistance 53.90 / 54.00 as a first target, bearing in mind that confirming the breach of 54.10 increases the chances of an upside move towards 54.70.

A reminder that trading once again below 52.50 is capable of negating the expected bullish scenario and leads oil once again to complete the bearish correction to visit 51.70, and then 51.30, a 23.60% correction.

| S1: 52.50 | R1: 54.10 |

| S2: 51.55 | R2: 54.70 |

| S3: 50.90 | R3: 55.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations