US crude oil futures were able to activate the scenario of re-testing the support, as we explained during the previous session’s trading, to re-test the support at 59.40, recording the lowest price of 49.50, to return to the upside rebound again, touching our target 61.30, recording a high of 62.26.

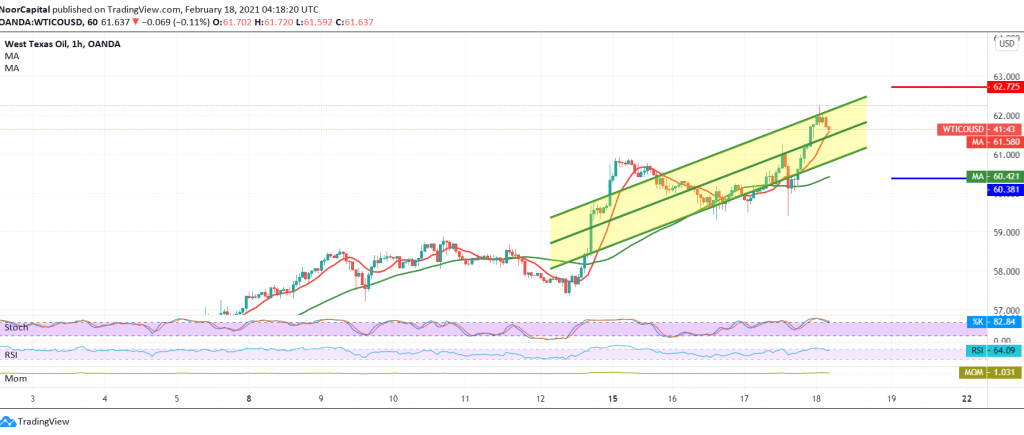

Technically, with a closer look at the 60-minute chart, we find the price is stable above the 50-day moving average, and we find the RSI indicator continues to defend the daily bullish trend. From here, and steadily trading above the support level of 60.30 encourages us to maintain our positive expectations targeting 62.70 the first target, and then 63.40 next stop.

Only from below, trading below 60.30 and stabilizing below it will stop the current bullish attempts and put the price under temporary negative pressure targeting a re-test of 59.40.

Reminder: Today we are awaiting the report issued by the International Energy Agency on oil inventories, and we may witness a high volatility in prices.

| S1: 60.00 | R1: 62.70 |

| S2: 58.40 | R2: 63.85 |

| S3: 57.30 | R3: 65.45 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations