US crude oil futures prices continue to achieve gains, supported by several factors that support prices, most notably the approval of OPEC members to reduce production by 2M bpd next month, to post $93.62 per barrel.

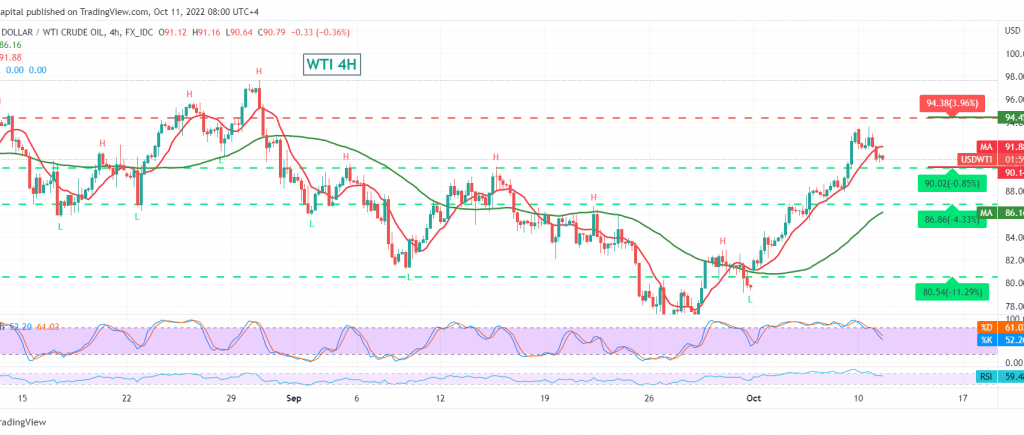

Technically, the current movements are witnessing a bearish tendency as a result of profit-taking operations after a positive session, and we find that Stochastic started to lose the bullish momentum temporarily, in addition to the stability of the intraday trading below 92.00.

We may witness a bearish bias in the coming hours, which aims to retest the floor of the psychological barrier 90.00 as a first target that may extend to visit 89.65 before attempts to rise again.

Note: the bearish bias does not contradict the daily bullish trend, knowing that stochastic may regain the bullish momentum again, and this is confirmed by the promise of trading stability above 92.00, and this increases the chances of touching 94.75.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations