US crude oil futures prices showed positive trading after it took advantage of the consolidation above the support floor of 98.65, which ended its trading today above it.

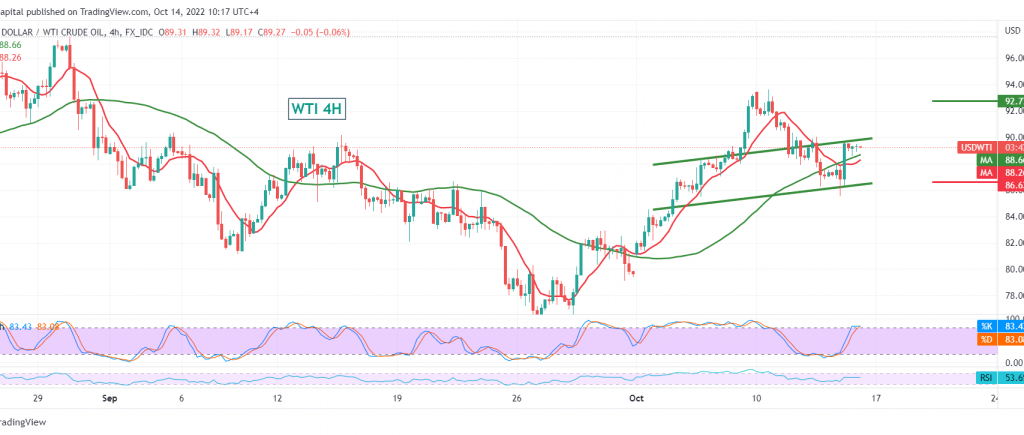

On the technical side, we tend in our trading to the positivity, relying on the positive signals coming from the RSI and its stability above the mid-line 50, in addition to the positive motive coming from the 50-day simple moving average.

Therefore, the bullish bias is most likely during the session, targeting 89.65 the first target and then 90.00 next stations. We must pay close attention and monitor the price behavior of oil around the 90.00 level, because the breach of it as a catalytic factor increases and accelerates the strength of the daily bullish trend, consolidating the rise towards 92.75 as long as the daily trading remains stable above 86.65.

Note: “US Retail Sales” is due today and may witness price fluctuation.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations