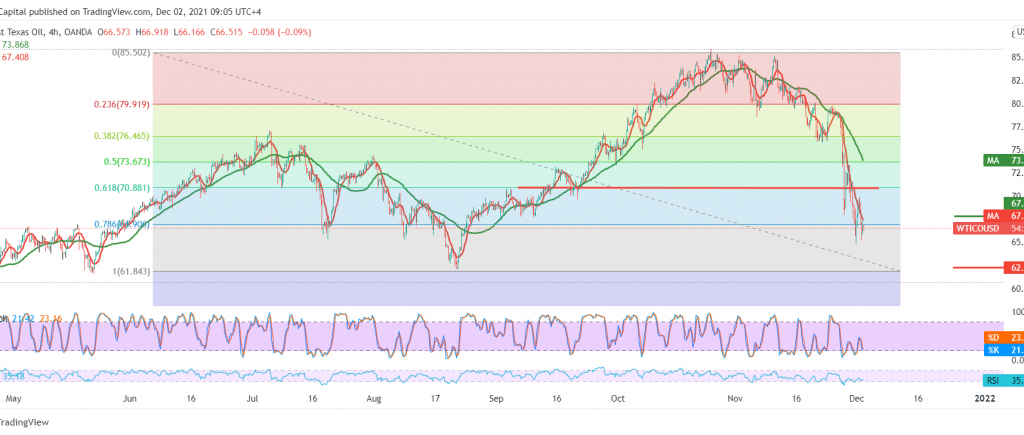

US crude oil futures prices continued their movements within the expected bearish path, recording its lowest level at 64.84 after hitting 47.50.

Technically, we tend to the negativity, relying on the negative pressure coming from the simple moving averages, which still constitute an obstacle to the price and the clear negative signs on the RSI due to the stability below the 50 mid-line.

Therefore, with daily trading remaining below 67.80, the bearish scenario will remain valid and effective, knowing that the price’s movement below the support floor 64.30 increases the strength of the bearish trend, so we will be waiting for the next 62.40 price station that may extend its targets later towards the 61.30 buying concentration area.

As we mentioned above, maintaining negative stability requires the price to remain below the resistance level of 67.80, and its breach increases the possibility of retesting 70.80, 61.80% correction before retracing.

Note: the level of risk is high

| S1: 64.30 | R1: 68.90 |

| S2: 62.30 | R2: 71.50 |

| S3: 59.65 | R3: 73.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations