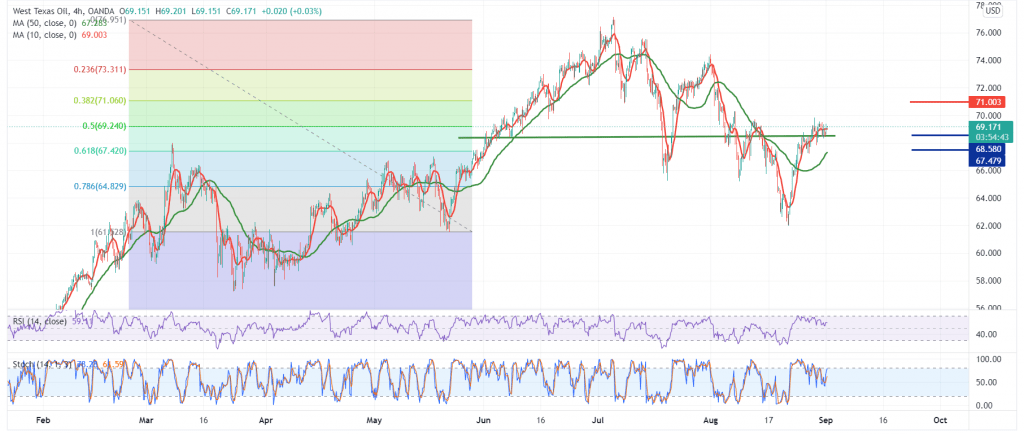

US crude oil attempts continue to rise within attempts to attack the pivotal resistance level published during the previous analysis at 69.25, explaining that it represents one of the official trend keys.

Technically, we find that the RSI provides positive signs that support the possibility of continuing the rise, in addition to the stability of trading above the support level of 68.30 and, most importantly, 68.00.

Although we prefer the positivity, we await confirmation of the breach of 69.25 Fibonacci corrections, and that is a catalyst that increases and accelerates and confirms the rise to visit 69.70 and 70.35, respectively, taking into account that the breach of the latter extends the gains to be waiting for the official target 71.00, 61.80% correction.

Breaking 68.00 will postpone the chances of rising, and we may witness a retest of 67.50 and 67.00 before attempts to rise again.

Not: OPEC Joint Ministerial Committee regarding production is due today, in addition to the report issued by the International Energy Agency regarding oil stocks, and we may witness high volatility in the market.

| S1: 68.30 | R1: 69.45 |

| S2: 67.70 | R2: 70.00 |

| S3: 67.10 | R3: 70.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations