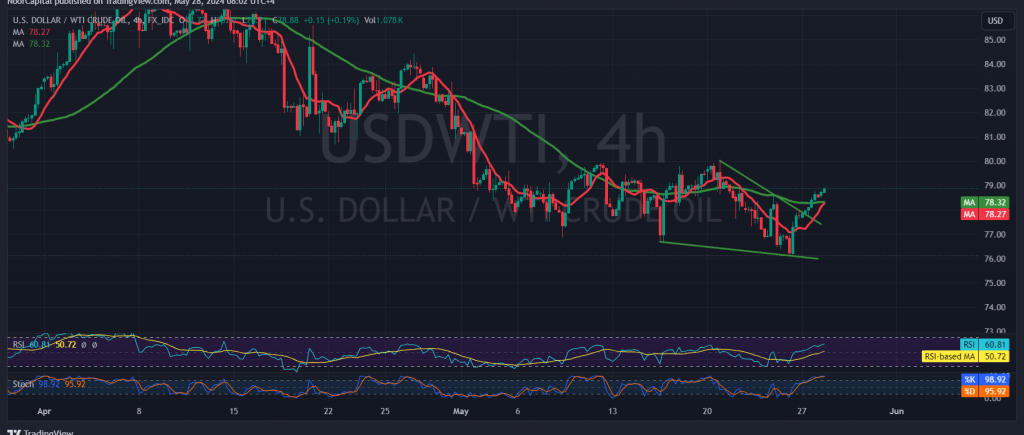

WTI crude oil futures prices have aligned with our previous technical forecast, reflecting a downward trend while trading below the $77.70 resistance level. However, as anticipated, a consolidation above this level triggered a recovery, pushing prices to a high of $78.90 in early trading today.

Technical Indicators Support Potential for Further Gains

A closer look at the 240-minute chart reveals emerging positive crossover signals among the simple moving averages. This, coupled with the positive Relative Strength Index holding above the 50 midline, indicates a potential continuation of the upward momentum.

Upward Targets and Potential Extension of Rally

The bullish scenario remains valid, with initial targets of $79.30 and $79.70. A decisive break above the latter could open the path for further gains, potentially reaching $80.50.

Downside Risks and Support Levels

Traders should remain cautious, as a sustained decline below $78.10, and more crucially $77.70, could invalidate the bullish outlook and expose prices to strong downward pressure. The initial downside target would be $76.90.

Cautionary Notes:

- US Economic Data: The release of the US Consumer Confidence Index later today may introduce significant price volatility.

- Geopolitical Tensions: Ongoing geopolitical uncertainties could also lead to sharp price fluctuations.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for WTI crude oil.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations