Mixed and predominantly negative trades characterized the movements of US crude oil futures, reaching a low of $67.74 per barrel, with current intraday stability around $69.50.

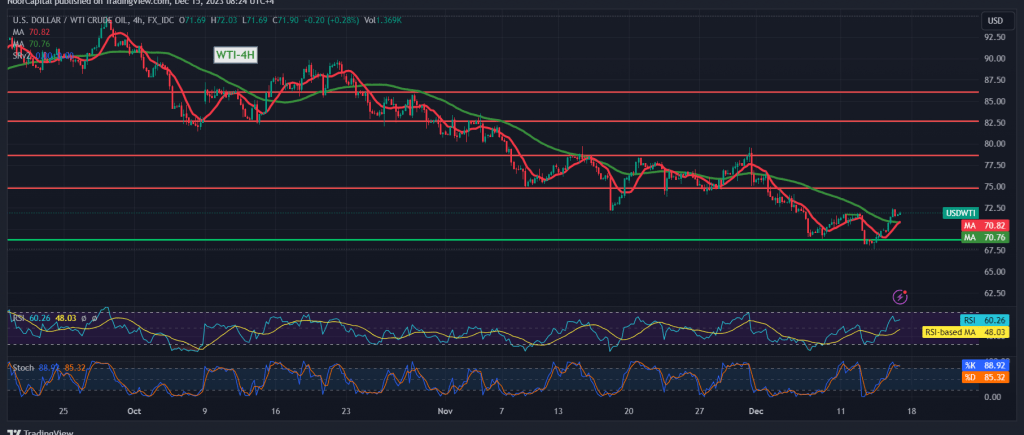

From a technical perspective, the simple moving averages continue to exert downward pressure on the price from above. A closer look at the 4-hour chart reveals signs of negativity dominating the Stochastic indicator, indicating a loss of upward momentum.

As a result, the bearish scenario is deemed more likely, contingent on trading staying below $70.00, especially $70.50. The initial target for this scenario is $68.15, and breaking below this level could extend oil’s losses towards $66.80.

It’s important to note that a return to trading stability above $70.50, confirmed by at least an hour candle, would invalidate the bearish scenario, prompting a quick recovery for oil towards $71.45 and $72.80.

Cautionary Note: The risk level is high. Today, significant economic data is expected from the British economy, including the Monetary Policy Summary, Interest Rate Decision, and Monetary Policy Committee vote on interest rates. Additionally, Eurozone economic data includes Interest Rate Decision, ECB Monetary Policy Statement, and ECB President’s press conference. From the United States, focus is on US retail sales. The geopolitical tensions persist, contributing to potential high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations